What is it?

The Business Plan is the key document to carry out your business idea. It is the written version of this idea, it summarizes the contents and describes the characteristics of your project. The Business Plan is an operational guide to your company or business project. It must be engaging, it must make it clear to those who read it that your idea is right and it must make clear how you are going to carry it out, how you are going to make those who will be making the decision to believe in you.

From BUSINESS MODEL CANVAS to Business Plan

Business Plan is the ideal continuation of the BUSINESS MODEL CANVAS. It translates the whole study phase and the feasibility analysis into figures that let you understand many things about the company. How is it doing? When will you start generating revenue? What is your break-even point? When will you have positive cash flow? How will you manage customers? How will you enhance your products or services? Who will your partners be? And so on.

Improve your BUSINESS MODEL CANVAS every day and you’ll find yourself with a ready-made Business Plan!

Business Plan is a management tool that summarizes the progress of your company or project in the form of data and statistics. There is no business, no company, no startup without a Business Plan.

When to use a Business Plan

The answer is very simple. Always. In this case, as for the Executive Summary, there are two types of Business Plan:

- Startup – if you are a launching a new business the Business Plan will end up being scrutinized by an investor. It will have to be convincing because otherwise, your project will never see the light of day. In this case, it will present the business idea in figures and focus on a feasibility plan. A very strong BUSINESS MODEL CANVAS will be essential. The rest will follow.

- Established Business – if you have experience as an entrepreneur, you should already know about this tool. Already it is your irreplaceable guide to company management. You just have to write the right BUSINESS MODEL CANVAS for the new activity to be undertaken, for a new product to be launched or to modify the one you are already using.

The Business Plan, in fact, is not a fixed document, written in stone. Far from it. It is a dynamic tool, constantly evolving and that needs to be constantly updated.

How you write it

The Business Plan is divided into various sections. You and your collaborators can fill in the different sections, complete them and comment on them with the appropriate editor. This list gives depth to the individual blocks of the Business Plan, which in any case will be a single document.

Key Partners

Enter the list of subjects or companies that you have chosen as a partner, collaborator, ally, or supplier. All those who are going to support you in the realization of your business plan. List their characteristics, explain why you think they are important for your project’s success, provide the data to support your assessment.

Key Activities

List in detail what the core activities are for the business model you have in mind. Do not include all the activities that your company intends to offer, but only those that are truly decisive for the execution of the Value Proposition.

Key Activities differ according to the chosen business sector:

- Products

- Services

- Infrastructures

Value Proposition

Explain to investors why your product, your service, and your business idea is right, what needs of the chosen market segment are met, what your answer is to this need, why your customers will choose you and not your competitors. When writing the Value Proposition, always remember to:

- Be brief and precise.

- Put customer needs at the center and how you might bring value.

- The value you can give your customers is not only economic convenience, but also time, quality or other values.

Customer Relations

A key element of Business Plan which is essential for already structured companies and is often underestimated by startups. The CRM plan is necessary to increase sales of your product, retain customers and improve profit margins. Through the CRM strategy:

- You get to know and value your customers. Identify purchase trends to find out who the most important and most profitable customers are.

- Acquire and store data in one place so you always have it at your fingertips and so you can test and refine your marketing strategies and increase sales.

- Create a targeted and personalized service for the customer. This is the way to keep the customer coming back to you.

- Acquisition of data on customer buying behavior will allow you to develop up-selling and cross-selling strategies.

- Improve efficiency through specific targeting and through reduced sales and marketing costs.

- It constantly monitors market trends and customer behavior. Acquire new customers using the data at your disposal.

Customer Segments

Define your target audience precisely. Subdivide your clients’ market by needs, behaviors, but also by age, sex, gender, ethnicity, profession, qualifications. Cross these built segments with your Value Proposition and explain why you decided to target a particular group or segments. This phase is very important for your overall strategy and for defining key resources.

Key Resources

Accurately explain what the strategic assets are to perform Key Activities and make your business successful. The choice and explanation of these resources is a key point in the business plan. It can be enclosed in 4 macro-categories:

- Physical – These are the tangible things you need to produce or sell your product or service like machines, points of sale, computers.

- Intellectual – Everything that the company has in terms of knowledge and intangible value: brands, patents, partnerships, databases.

- Human – There is no successful company if the people who work there are not the right people. Explain why some professionals will allow you to make a difference with competitors.

- Financial – What gives you an edge from the financial path point of view? In this part, insert the reasons why you can take advantage of the market thanks to economic resources that make you stronger than your competitors in the acquisition of physical, intellectual and human resources.

Channels

Write in detail about the distribution, sales and communication channels you have chosen in order to reach your target. These are what is known as touch points. Enter them in order of importance, explaining why they will work with your customers.

Financial Plan (Costs & Revenues)

This is perhaps the decisive part of the business plan. All the other sections are important but the Financial Plan must convince an investor or manager to take a risk on your project. Financial sustainability must be detailed and precise, accompanied by clear and comprehensive tables and graphs. It is the detailed exposition of costs and revenues, how much your products or services will cost when your business will become a winner. The essential elements are:

- Sales Forecast – These are your sales predictions. It must be for a minimum of three years, divided monthly or for periods less than one year, in which the number of units sold, the price of the product per unit and the cost of sales to establish the gross margin, is predicted.

- Expenses Budget – These are costs, usually divided into fixed costs and variable costs. The lower the fixed costs, the greater the chance that your business will be successful.

- Cash-flow Statement – The financial statement is the king of the Financial Plan. It clearly explains the cash flow, or how much money will go out of your business and how much will come in.

- Income Projections – This is the result of the first three points, the forecast of your profits and losses in the coming years. Discover the net profit once deducted from the gross margin, expenses, interest, and taxes.

- Assets and Liabilities – Take into account the assets, holdings available to you and fixed liabilities that are not part of revenues and losses.

- Break-even – Especially in startups, an analysis to understand when your business will become profitable is fundamental, that is when your expenses will be matched by sales.

Metrics

In this section, explain what the metrics are, the numbers you have chosen to monitor your business. For example, you can compare your results in terms of sales with the original aims. Or monitor the efficiency of your human resources. Metrics can be multiple and can cover every sector of your business. Let us have a look at some possibilities:

- CAC – The cost incurred by the company to acquire a new customer.

- Like for Like – The comparison between turnover or sales compared to business objectives.

- LTV – The value of a customer in the time frame in which they remain your customer.

- ROI – Literally, this is the return on investment or the relationship between costs and profits. One of the most important and considered metrics by those who will read your Business Plan.

Business Metrics

EBIT

EBITDA – Earnings before interest, taxes, depreciation, and amortization

Free cash flow

Revenues

Financial Sources

In your plan, make a detailed list of how you will find the funds to finance your business. Please indicate all sources accurately, especially if your Business Plan ends up on an investor’s table for your startup. These are the main sources:

- Friends

- Family

- Personal savings

- Venture Capital

- Angel Investors

- Government incentives

- Equity Crowdfunding

- ICOs

Market Dial

Build a matrix to visually represent the channels you have chosen to position your product on the market and where they are placed on traditional/innovative, virtual/physical, web/mobile and so on.

Competitors

Visually present a competitive analysis of your main competitors in the market segment you wish to occupy and in neighboring segments. Emphasise in a timely, concise and truthful manner what their strengths and weaknesses are. Analyse their strategies, products, pricing, locations, customers, data and financial resources, the brand.

Technology

Explain how technology will impact on your business plan, what your strategies are for reducing costs by increasing the efficiency of your business, what investments you will make for computer security, which technologies you will acquire to keep up with your competitors, which technologies you will subcontract externally.

Revenue Run Rate (also run rate – one word) is the annualized revenue of a company if you were to extrapolate the current revenue over a year. Run rates are useful for new business or business units within a company that has only had a short period of revenue generation opportunity. This figure allows managers, venture capitalists and investors to measure the annualized revenue. If a business unit were to make $1m in its first month of operation then its revenue run rate would be $12m. E.g. during the month of November, in the UK, a business that sold Christmas decorations and costumes would have a much higher revenue than in any other month of the year, probably by a magnitude of at least 100. If you were to generate the revenue run rate from November’s financial figures for this business then it would overstate the business’ annual revenue by a large number.

Average revenue per user is a measure of how much income a business generates, given the size of its customer base. The average revenue per user (ARPU), often utilized in the technology and telecommunications sectors, helps determine the potential profitability of a firm. To calculate ARPU, simply divide the organization’s annual revenue by the number of people using its services. ARPU is a useful tool to help investors determine the potential earnings growth of a company. In the technology industry, it’s not uncommon for a business to amass a large user base in its early years, but without the ability to generate substantial revenue from the average user. If investors believe the company can increase ARPU over time, they’ll be willing to pay a higher price per share.

Customer Acquisition Cost is the cost associated with convincing a customer to buy a product/service.This cost is incurred by the organization to convince a potential customer. This cost is inclusive of the product cost as well as the cost involved in research, marketing, and accessibility costs. This is an important business metric. It plays a major role in calculating the value of the customer to the company and the resulting return on investment (ROI) of acquisition. The calculation of customer valuation helps a company decide how much of its resources can be profitably spent on a particular customer. In general terms, it helps to decide the worth of the customer to the company.

Customer Acquisition Cost (abbreviated to CAC) refers to the resources that a business must allocate (financial or otherwise) in order to acquire an additional customer.Numerically, customer acquisition cost is typically expressed as a ratio — dividing the sum total of CAC by the number of additional patrons acquired by the business as a result of the customer acquisition strategy.

Churn rate, also known as the rate of attrition, is the percentage of subscribers to a service who discontinue their subscriptions to that service within a given time period. For a company to expand its clientele, its growth rate, as measured by the number of new customers, must exceed its churn rate. The rate is generally expressed as a percentage. E.g. If one out of every 20 subscribers to an online service discontinued his service within a year, the annual churn rate for that service provider would be 5%. To be counted as part of the churn rate, the customer does not necessarily have to move his service to a different provider; he just has to terminate his relationship with the current provider. This measurement is most valuable in subscriber-based businesses in which subscription fees make up the bulk of the company’s revenue.

Burn rate is normally used to describe the rate at which a new company is spending its venture capital to finance overhead before generating positive cash flow from operations; it is a measure of negative cash flow. Burn rate is usually quoted in terms of cash spent per month. E.g. Startup companies and investors use the burn rate to track the amount of monthly cash that a company spends. A company’s burn rate is also used as a measuring stick for its runway, the amount of time the company has before it runs out of money. So, if a company has $1 million in the bank, and it spends $100,000 a month, its burn rate would be $100,000 and its runway would be 10 months, derived as: ($1,000,000) / ($100,000) = 10.

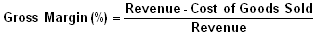

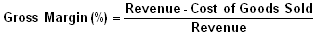

Operational efficiency is primarily a metric that measures the efficiency of profit earned as a function of operational costs. Operational efficiency in the investment markets is typically centered around transaction costs associated with investments. Operational efficiency in the investment markets can be compared to general business practices for operational efficiency in production. Operationally efficient transactions are those that are exchanged with the highest margin, meaning an investor seeks to pay the lowest fee to earn the highest profit. Similarly, companies seek to earn the highest gross margin profit from their products by manufacturing goods at the lowest cost. In nearly all cases, operational efficiency can be improved by economies of scale. In the investment markets, this can translate to buying more shares of an investment at a fixed trading cost to reduce the fee per share. A market is reported to be operationally efficient when conditions exist allowing participants to execute transactions and receive services at a price that equates fairly to the actual costs required to provide them. Operationally efficient markets are typically a byproduct of competition which is a significant factor improving the operational efficiency of participants. Operationally efficient markets may also be influenced by regulation which caps fees to protect investors against exorbitant costs. An operationally efficient market may also be known as an “internally efficient market”. Gross margin is a company’s total sales revenue minus its cost of goods sold(COGS), divided by total sales revenue, expressed as a percentage. The gross margin represents the percent of total sales revenue that the company retains after incurring the direct costs associated with producing the goods and services it sells. The higher the percentage, the more the company retains on each dollar of sales, to service its other costs and debt obligation.

Gross margin is a company’s total sales revenue minus its cost of goods sold(COGS), divided by total sales revenue, expressed as a percentage. The gross margin represents the percent of total sales revenue that the company retains after incurring the direct costs associated with producing the goods and services it sells. The higher the percentage, the more the company retains on each dollar of sales, to service its other costs and debt obligation. The gross margin number represents the portion of each dollar of revenue that the company retains as gross profit. For example, if a company’s gross margin for the most recent quarter is 35%, that means it retains $0.35 from each dollar of revenue generated. It spends the remainder on COGS. As COGS have already been taken into account, the remaining funds can be put toward paying off debts, general and administrative expenses, interest expenses and distribution to shareholders.

E.g. To illustrate how to calculate gross margin, imagine a business collects $200,000 in sales revenue. It spends $20,000 on manufacturing supplies and $80,000 on labor costs. After subtracting its COGS, it has $100,000 in gross profits. Dividing gross profits by revenue equals 0.5, and when multiplied by 100, that becomes 50%.