PGF500 has a token on the Ethereum network, called PGF7T, which you can use to pay for subscriptions and services within the PGF500 platform.

You will need to have Metamask to pay with PGF7T token.

.

We have chosen to adopt blockchain technology for the launch of 2 innovative decentralized Dapps.

.

We believe in Web3 and in the strength of communities.

.

.

.

The token is on the Ethereum smart contract 0x9fadea1aff842d407893e21dbd0e2017b4c287b6 ,

and the code is public at https://etherscan.io/address/0x9fadea1aff842d407893e21dbd0e2017b4c287b6#code

.

QuickSwap smart contract:

0xdd0fDc648a9dbC9be5A735FE4561893a13399Da2

.

.

🔴 It is possible to buy and sell PGF7T tokens on Uniswap and QuickSwap Exchanges.

.

Price: PGF7T

.

.

.

.

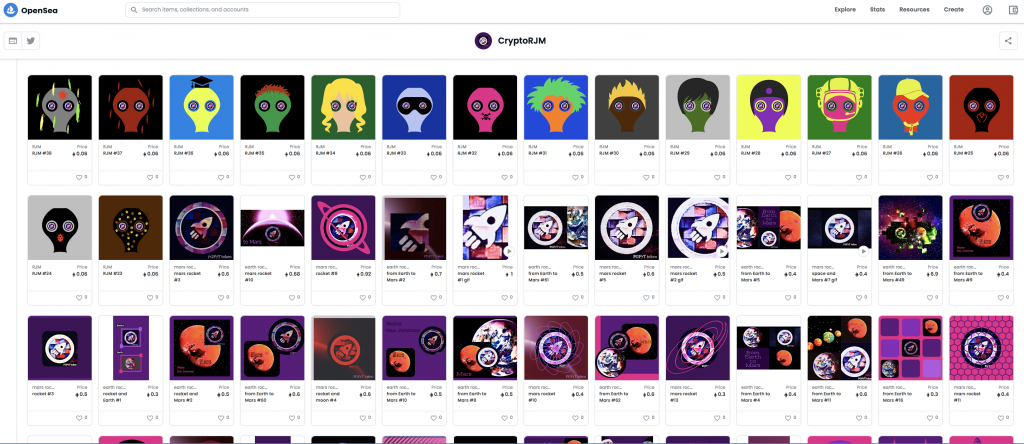

Our NFTs

.

Enjoy the Journey 🚀

.

PGF500 Team

.