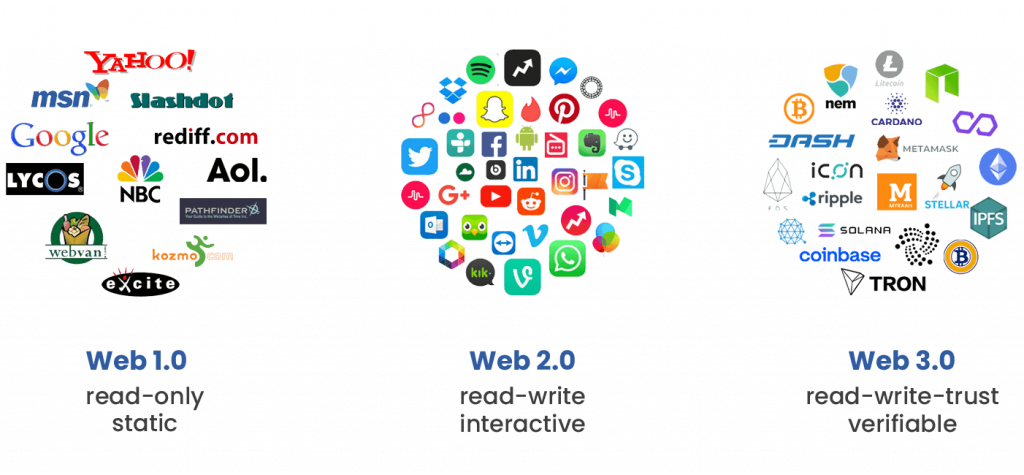

Every technology goes through generational cycles, including the internet. When a critical threshold of upgrades is crossed, it marks the beginning of a new generation. This moment, and its significance for the marketplace, can prove confusing.

.

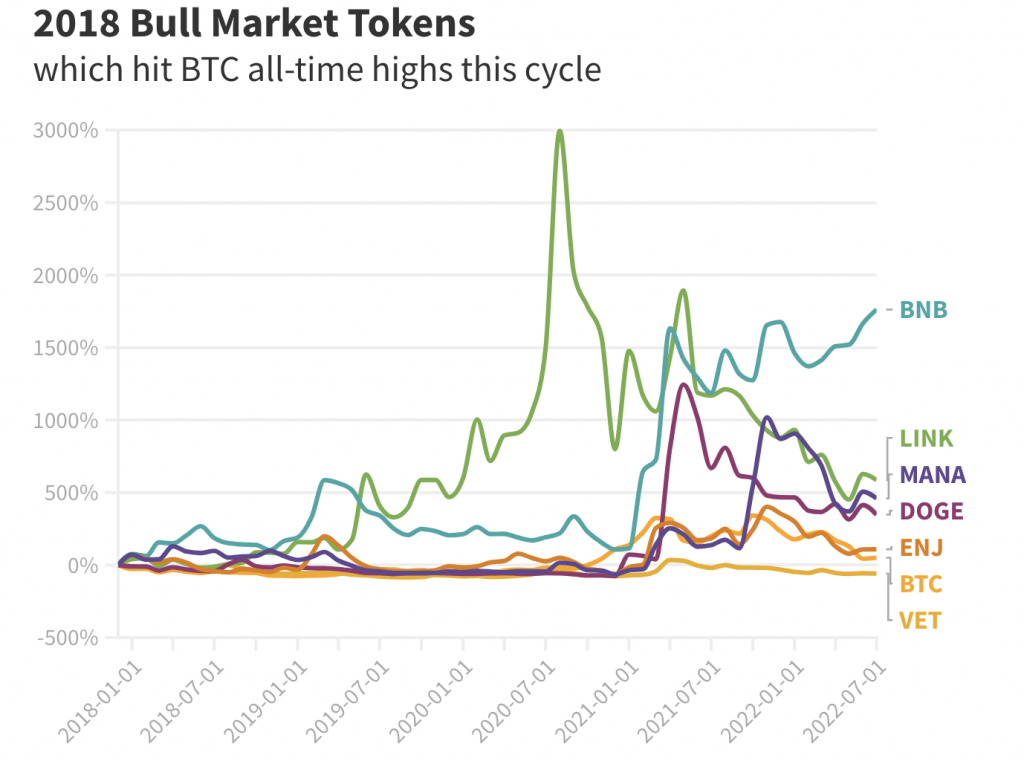

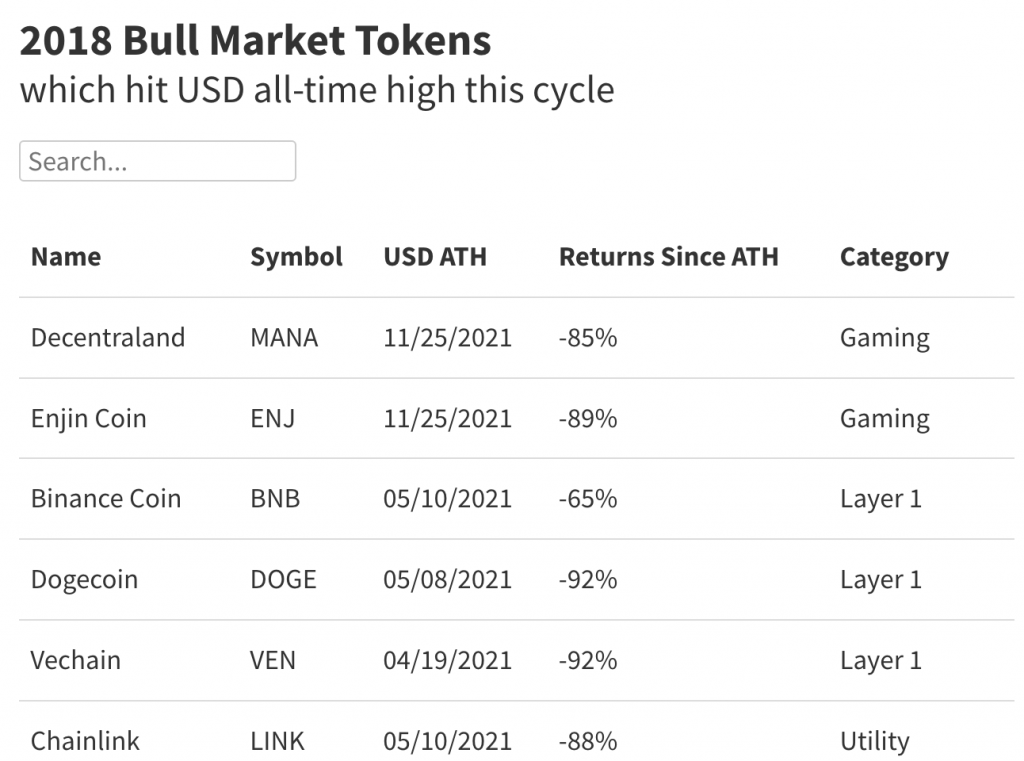

After all, the features that existed in the first generation still exist, only with additional layers. This is what happened when Web1 morphed into Web2 and now we see this occurring in the shift to Web3. Let’s start differentiating them:

.

The Path to Web3 Explained

.

Web 1.0 vs. Web 2.0 vs. Web 3.0. Source: Myraah

.

In the late-90s, the internet was just starting to go mainstream. The Web1 era was highly decentralized for a couple of reasons:

-

Low bandwidth infrastructure (up to 1Mbps) precluded the media-heavy internet as we know it today, with 4K video-streaming platforms.

-

Underdeveloped infrastructure went hand-in-hand with simple coding practices. Everyone could learn HTML or copy a template to deploy a website, as they were built Server-side: generating web content and database query on servers.

As a result, Web1 was static, simple, and non-interactive, making it possible for everyone to create their own websites — blogs, news, forums, and yellow pages. Most internet content was centered around personal web pages hosted on ISP-provided servers, often for free.

.

Over time, telecom companies built broadband infrastructure (above 10Mbps) and spurred entrepreneurs to develop new ventures that deepened the experience, and the economics, of the internet.

In the late-’00s, ventures such as YouTube and Netflix scaled as they delivered streamed content to the mass market.

More complicated software stacks began to emerge as the internet demonstrated it was a new channel for television, radio, and publishing.

.

Customize Stacks

Alongside HTML, the Web2 software stack includes PHP, CSS, JavaScript, Ajax, HTML5, Java, Ruby, and other programming languages.

In essence, Web2 is the merger of Server-side (programs executed on a server) and Client-side (programs executed in a browser) programming, with web browser languages as the starting point:

-

Web browser stack: HTML, JavaScript, CSS

-

More advanced Server-side and Client-side stack: PHP, JavaScript, Ruby, Python, Java

-

Additionally, to scale up web development more easily and maintain large websites, Server-side web frameworks emerged: Django, Ruby on Rails, Laravel, and other scripting libraries.

Web developers often customize their stacks. For example, the MEAN stack consists of MongoDB, Express.js, AngularJS/Angular, and Node.js. Or, they could focus on the MERN stack: MongoDB, Express.js, React, and Node.js.

These programming layers made it possible to create dynamic web content, sandwiched between Client-side and Server-side.

Such platforms manifest as Vimeo, YouTube, Twitter, (Meta) Facebook, and TikTok. All of them have in common increased user interaction and effortless content contribution, enabled by Client-side web stacks.

.

Web2 Centralization

Web2 was predicated on raising capital and traditional management of business. That meant centralization. Additional programming stacks made web content both labor and hosting intensive.

Moreover, no individual or small business could pay for vast months of data traffic delivered through video sharing and social media platforms. On top of that, the network effect took place. Even if someone could clone Twitter, the value of Twitter is not in its software, but in the number of people using it. Even former Twitter CEO, Jack Dorsey, admitted as much.

.

In other words, as people became dependent on Web2 platforms, they magnetized them for further growth, dulling even quality competition.

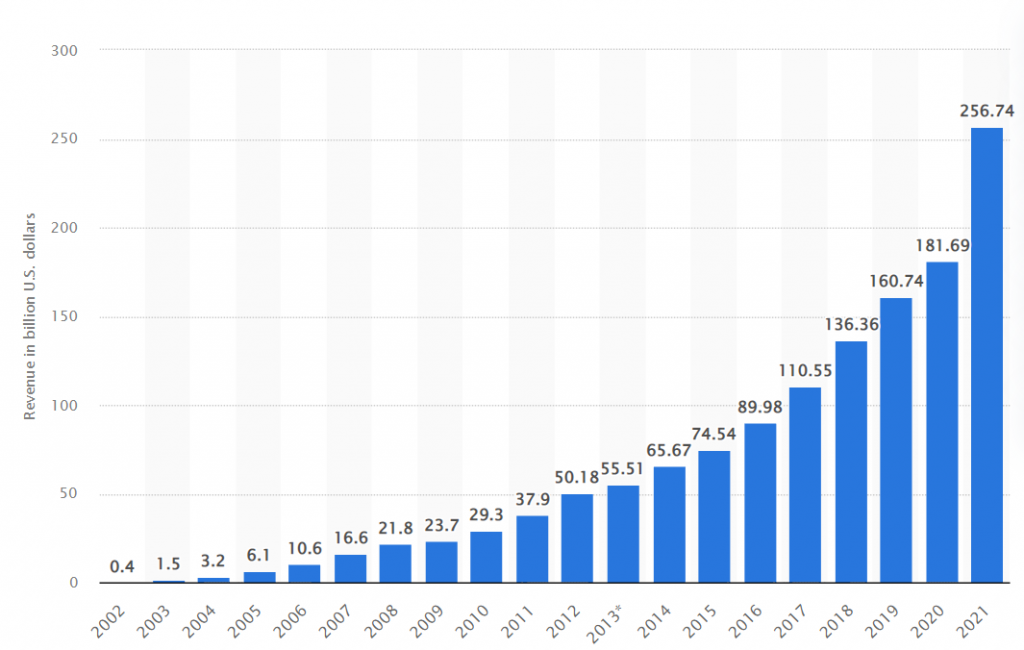

This is best exemplified by companies like Google. It went from a search engine start-up to a go-to platform (Alphabet) for everything under the sun — ad integration and monetization, news aggregation, video-sharing, payment rails, AI, robotics, and smartphones.

.

.

Google’s annual revenue from 2002 to 2021, exemplifying power and wealth concentration during Web2. Source: Statista

.

As if corporations in control of user data weren’t enough, an extra problem surfaced — deplatforming and inter-corporate collusion. Companies control who uses their platforms.

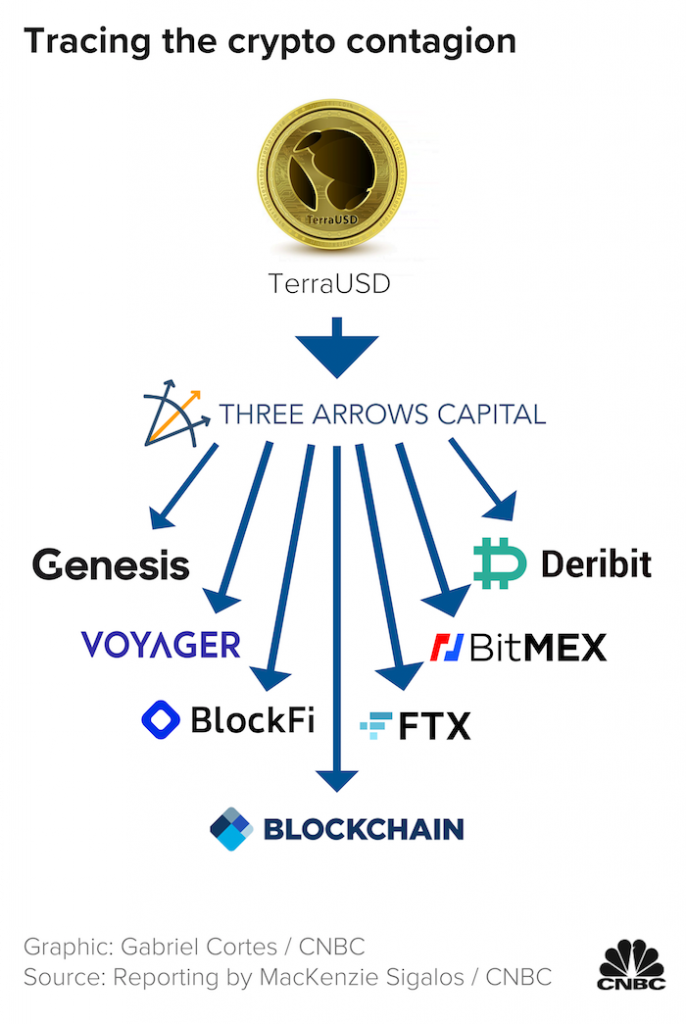

In the end, Web2 turned into an ecosystem made up of a handful of tightly-regimented nodes. These nodes make it convenient to interact with the world, but companies control the nodes and can change their policies when they like.

.

Web3 Explained

When all is said and done, everything is about the concentration of power. The more a system is centralized, the more it yields lopsided results.

Case in point, when the Federal Reserve started bailing out commercial banks during the Crash of 2008 by pumping $498B into their balance sheets, the Occupy Wall Street movement expressed outrage at the use of taxpayer funding.

Protests and movements come and go, but technology stays. A year after the Great Recession of 2008–09, Bitcoin emerged as peer-to-peer (P2P) digital money, its genesis block directly referencing bank bailouts. Bitcoin emerged as an alternative to central banking.

Bitcoin’s blockchain technology also laid the groundwork for Web3. After all, if money can be made both digital and decentralized, it is a layer that can easily be integrated into the internet.

From file storage (IPFS) and video streaming (Livepeer) to monetization, smart contracts in chained data blocks are agnostic to which content is decentralized.

In other words, Web3 mirrors Bitcoin — it is a permissionless, trustless, and decentralized way of generating content, distributing it, and owning it.

.

How Does Web3 Work?

Just as different programming stacks defined Web1 and Web2, a new software stack defines Web3 to make decentralized internet happen. Web3 is in many ways a continuation of Web2 in terms of interactivity, but at the bottom of the stack is a blockchain protocol.

On top of the blockchain protocol are four layers that bind blockchain to the end-user experience:

-

Smart contracts are embedded into each data block. Because they chain together, smart contracts are immutable, which is also what makes both NFTs and cryptocurrencies so valuable. Ethereum is the leading platform for deploying smart contracts written in Solidity. Other blockchains, such as Cardano, use Haskell.

-

Web3 libraries that link smart contracts to dApp interfaces: ethers.js, web3.js, or web3.py

-

Nodes as blockchain’s decentralization cornerstones, linking Web3 libraries to smart contracts. Instead of relying on a centralized cluster of servers, blockchain networks are dispersed across computer nodes. For example, Bitcoin has over 14,000 nodes, while IPFS (Interplanetary File System) for decentralized storage has over 200,000 nodes.

-

Wallets that connect to blockchain networks and individual dApps on them. Wallets should not be considered as containers. Instead, crypto wallets like MetaMask unlock access to blockchains and their dApps, via private keys.

.

With these Web3 layers in play, it is possible to replicate every existing Web2 platform. They offer the same Web2 functionality but with decentralized monetization, funds/data ownership, and censorship-resistant content.

.

Web3 Examples

LinkedIn is a centralized platform for job hunting and business networking. LinkedIn’s decentralized version is Indorse.io.

This platform uses Indorse tokens (IND) to monetize the platform and establish voting governance. IND tokenholders could then use their tokens to “indorse” either prospective employers or employees.

There are also YouTube decentralized equivalents in the form of D.tube and Odysee, one built on IPFS and the other on LBRY file-sharing and monetization network. Later on, Odysee split into its own video-sharing company. It has since matured into a viable YouTube alternative, but without YouTube’s intense censorship.

.

.

Source: Odysee

.

When it comes to Web3 social media, the leading lending dApp, Aave, launched Lens Protocol in which the entire social pipeline is tokenized. Users can not only store their own content — posts and comments — as censorship-resistant NFTs, but they can do the same for their followers.

Because everything is tokenized, this means that users have complete control over their online interactions, but without being censored by central entities.

.

Web3 Apps To Replace Web2 Tech

There is no shortage of Web3 dApps. They link back Web1’s initial selling point — decentralization. But now they havetokenized monetization and ownership via wallets. The problem is, they are unlikely to amass much adoption unless Web2 platforms begin to deplatform and censor even more aggressively.

Ultimately, most people prefer the easiest shortcut that requires the least amount of effort. This is where Web2 platforms exce.

Nonetheless, Web3 on a global scale could coalesce into a rival mega-meta Web3 platform in which all blockchain networks are interlinked, and tokens are easily swappable on decentralized exchanges (DEXs).

They may require extra steps and more engagement, but many will see it as a worthwhile and necessary effort.

.

What Is Web3?

.

—-