Crypto Venture Firm Dragonfly Acquires Hedge Fund Backed By A16z, Sequoia

Dragonfly buys early Ethereum, Algorand investor

.

-

Dragonfly purchases early Ethereum investor in undisclosed deal

-

Dragonfly managing partner Haseeb Qureshi formerly worked as a partner at the hedge fund firm

.

Cryptocurrency-focused venture capitalist Dragonfly has purchased its first digital assets hedge fund firm backed by Sequoia and a16z.

The acquisition, MetaStable, founded in 2014, is one of the oldest and highest-performing crypto hedge funds. MetaStable was an early investor in Ethereum, Filecoin and Algorand — at one point raking in a return in excess of 500%.

More recently, the fund has invested in trading platform Floating Point Group and layer-1 protocol Iron Fish.

Dragonfly managing partner Haseeb Qureshi, who formerly worked as a partner at MetaStable, in a blog post Monday said the firm is now “more expansive than it’s ever been.”

The news comes months after Dragonfly, based in San Francisco, CA, closed its third crypto venture fund at an oversubscribed $650 million. Its second fund, closed in 2021, cleared $250 million. The company remains interested in native protocols, Web3 initiatives and tokens that aim to create new digital economies, General Partner Tom Schmidt said in May.

Dragonfly will also soon be the new owner of 10 million LDO tokens — equal to 1% of the total supply — after the Lido DAO approved the sale earlier this month. Lido is a liquidity platform where traders can earn yields on staked assets. LDO token holders came to an agreement after floating different versions of the proposal.

Dragonfly committed to buying the LDO tokens at $1.45 apiece, or at the two-week average price as of the vote plus a 5% premium, whichever is higher. There is a one-year lockup period.

As part of a brand overhaul, also announced Monday, the firm has dropped “Capital” from its name.

The acquisitions and rebranding effort fit into Dragonfly’s broader goal to reintegrate itself as a crypto-native brand. Its new look is affectionately inspired by the “hacker” and “weirdo” culture often displayed throughout the space, according to Qureshi.

.

“It’s time for a refresh,” Qureshi said.

.

Crypto Venture Firm Dragonfly Acquires Hedge Fund MetaStable

.

——

PGF7T crypto info, Web3, NFTs, Dapps 🔴🔴🔴

PGF500 has a token on the Ethereum network, called PGF7T, which you can use to pay for subscriptions and services within the PGF500 platform.

You will need to have Metamask to pay with PGF7T token.

.

We have chosen to adopt blockchain technology for the launch of 2 innovative decentralized Dapps.

.

We believe in Web3 and in the strength of communities.

.

.

.

The token is on the Ethereum smart contract 0x9fadea1aff842d407893e21dbd0e2017b4c287b6 ,

and the code is public at https://etherscan.io/address/0x9fadea1aff842d407893e21dbd0e2017b4c287b6#code

.

QuickSwap smart contract:

0xdd0fDc648a9dbC9be5A735FE4561893a13399Da2

.

.

🔴 It is possible to buy and sell PGF7T tokens on Uniswap and QuickSwap Exchanges.

.

Price: PGF7T

.

.

.

.

Our NFTs

.

Enjoy the Journey 🚀

.

PGF500 Team

.

~~~

Airbnb Business Model Canvas

Fundraising in an Economic Downturn. What to Expect and How to Win

Event Information

.

The rules have changed in fundraising. How should you play this new game?

For 2+ years, everything was up and to the right with endless optimism…

.

Fundraising in that environment was fast and loose. It seemed like everyone was getting term sheets without much stress.

Then, came Spring 2022 when everything changed. Markets crashed and optimism was replaced with FUD (Fear, Uncertainty, and Doubt).

Everyone is telling you to wait it out. Hold your breath until the fall and start your fundraise then.

But why??

And How??

.

By the end of this workshop, founders will:

• Get a deep understanding of the changing dynamics of startup capital

• Know how to avoid the pitfalls of fundraising tactics that don’t work in this new market

• Develop an approach to effectively fundraise in Q4 and beyond

.

Fundraising in an Economic Downturn

.

——

SaaStr Annual 2022 | Sep 13-15 in SF Bay Area!!

SAASTR ANNUAL IS THE WORLD’S LARGEST COMMUNITY GATHERING FOR CLOUD AND SAAS PROFESSIONALS IN THE WORLD.

If you’re a B2B founder, exec, or investor, SaaStr Annual 2022 is a must-attend event!

Learn more about the benefits of attending here.

We can’t wait to host you at the world’s largest SaaS community event.

.

REGISTER FOR SAASTR ANNUAL 2022

.

.

——

PGF7T crypto info, Web3, NFTs, Dapps

PGF500 has a token on the Ethereum network, called PGF7T, which you can use to pay for subscriptions and services within the PGF500 platform.

You will need to have Metamask to pay with PGF7T token.

.

We have chosen to adopt blockchain technology for the launch of 2 innovative decentralized Dapps.

.

We believe in Web3 and in the strength of communities.

.

.

.

The token is on the Ethereum smart contract 0x9fadea1aff842d407893e21dbd0e2017b4c287b6 ,

and the code is public at https://etherscan.io/address/0x9fadea1aff842d407893e21dbd0e2017b4c287b6#code

.

QuickSwap smart contract:

0xdd0fDc648a9dbC9be5A735FE4561893a13399Da2

.

.

🔴 It is possible to buy and sell PGF7T tokens on Uniswap and QuickSwap Exchanges.

.

Price: PGF7T

.

.

.

.

Our NFTs

.

Enjoy the Journey 🚀

.

PGF500 Team

.

~~~

Ethereum Merge | The Most Anticipated Event In Crypto, Video

What is The Merge all about?

.

-

Motivations behind this upgrade

-

Mechanics

-

Client Diversity

-

Merge implications

-

Common misconceptions

-

Potential risks

full video here

.

.

—–

End of easy money in crypto: 20% returns over in CeFi, DeFi lives on

The death of easy money: Why 20% annual returns are over in crypto lending

.

KEY POINTS

.

-

Developers gathered for various crypto events in Paris last week told CNBC the days of cheap money in crypto are over.

-

Much of the lending corner of the crypto market operates in a black box.

-

Voyager Digital and Celsius competed for users on APY, but a lot of the so-called yield they offered customers wasn’t real..

.

Celsius and Voyager Digital were once two of the biggest names in the crypto lending space, because they offered retail investors outrageous annual returns, sometimes approaching 20%. Now, both are bankrupt, as a crash in token prices — coupled with an erosion of liquidity following a series of rate hikes by the Federal Reserve — exposed these and other projects promising unsustainable yields.

″$3 trillion of liquidity will likely be taken out of markets globally by central banks over the next 18 months,” said Alkesh Shah, a global crypto and digital asset strategist at Bank of America.

But the washout of easy money is being welcomed by some of the world’s top blockchain developers who say that leverage is a drug attracting people looking to make a quick buck — and it takes a system failure of this magnitude to clear out the bad actors.

“If there’s something to learn from this implosion, it is that you should be very wary of people who are very arrogant,” Eylon Aviv told CNBC from the sidelines of EthCC, an annual conference that draws developers and cryptographers to Paris for a week.

“This is one of the common denominators between all of them. It is sort of like a God complex — ‘I’m going to build the best thing, I’m going to be amazing, and I just became a billionaire,’” continued Aviv, who is a principal at Collider Ventures, an early-stage venture capital blockchain and crypto fund based in Tel Aviv.

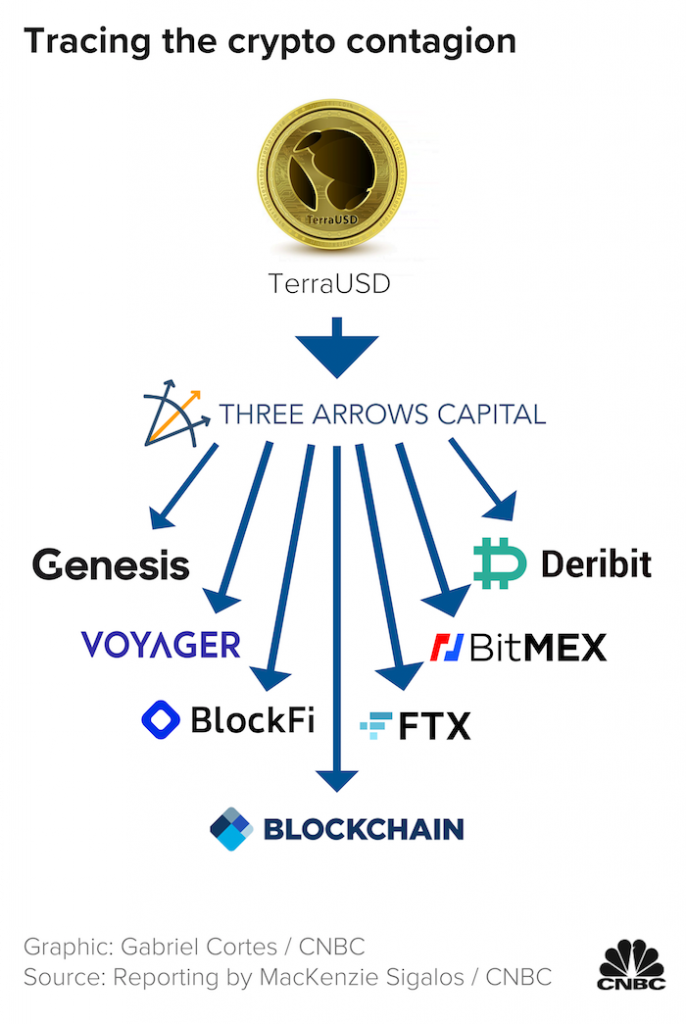

Much of the turmoil we’ve seen grip crypto markets since May can be traced back to these multibillion-dollar crypto companies with centralized figureheads who call the shots.

“The liquidity crunch affected DeFi yields, but it was a few irresponsible central actors that exacerbated this,” said Walter Teng, a Digital Asset Strategy Associate at Fundstrat Global Advisors.

.

The death of easy money

Back when the Fed’s benchmark rate was virtually zero and government bonds and savings accounts were paying out nominal returns, a lot of people turned to crypto lending platforms instead.

During the boom in digital asset prices, retail investors were able to earn outlandish returns by parking their tokens on now defunct platforms like Celsius and Voyager Digital, as well as Anchor, which was the flagship lending product of a since failed U.S. dollar-pegged stablecoin project called TerraUSD that offered up to 20% annual percentage yields.

The system worked when crypto prices were at record highs, and it was virtually free to borrow cash.

But as research firm Bernstein noted in a recent report, the crypto market, like other risk-on assets, is tightly correlated to Fed policy. And indeed in the last few months, bitcoin along with other major cap tokens have been falling in tandem with these Fed rate hikes.

In an effort to contain spiraling inflation, the Fed hiked its benchmark rate by another 0.75% on Wednesday, taking the funds rate to its highest level in nearly four years.

Technologists gathered in Paris tell CNBC that sucking out the liquidity that’s been sloshing around the system for years means an end to the days of cheap money in crypto.

“We expect greater regulatory protections and required disclosures supporting yields over the next six to twelve months, likely reducing the current high DeFi yields,” said Shah.

Some platforms put client funds into other platforms that similarly offered unrealistic returns, in a sort of dangerous arrangement wherein one break would upend the entire chain. One report drawing on blockchain analytics found that Celsius had at least half a billion dollars invested in the Anchor protocol which offered up to 20% APY to customers.

“The domino effect is just like interbank risk,” explained Nik Bhatia, professor of finance and business economics at the University of Southern California. “If credit has been extended that isn’t properly collateralized or reserved against, failure will beget failure.”

Celsius, which had $25 billion in assets under management less than a year ago, is also being accused of operating a Ponzi scheme by paying early depositors with the money it got from new users.

.

CeFi versus DeFi

.

So far, the fallout in the crypto market has been contained to a very specific corner of the ecosystem known as centralized finance, or CeFi, which is different to decentralized finance, or DeFi.

Though decentralization exists along a spectrum and there is no binary designation separating CeFi from DeFi platforms, there are a few hallmark features which help to place platforms into one of the two camps. CeFi lenders typically adopt a top-down approach wherein a few powerful voices dictate financial flows and how various parts of a platform work, and often operate in a sort of “black box” where borrowers don’t really know how the platform functions. In contrast, DeFi platforms cut out middlemen like lawyers and banks and rely upon code for enforcement.

A big part of the problem with CeFi crypto lenders was a lack of collateral to backstop loans. In Celsius’ bankruptcy filing, for example, it shows that the company had more than 100,000 creditors, some of whom lent the platform cash without receiving the rights to any collateral to back up the arrangement.

Without real cash behind these loans, the entire arrangement depended upon trust — and the continued flow of easy money to keep it all afloat.

….

….

.

End of easy money in crypto: 20% returns over in CeFi, DeFi lives on

.

——

PGF7T crypto info, Web3, NFTs, Dapps 💎

PGF500 has a token on the Ethereum network, called PGF7T, which you can use to pay for subscriptions and services within the PGF500 platform.

You will need to have Metamask to pay with PGF7T token.

.

We have chosen to adopt blockchain technology for the launch of 2 innovative decentralized Dapps.

.

We believe in Web3 and in the strength of communities.

.

.

.

The token is on the Ethereum smart contract 0x9fadea1aff842d407893e21dbd0e2017b4c287b6 ,

and the code is public at https://etherscan.io/address/0x9fadea1aff842d407893e21dbd0e2017b4c287b6#code

.

QuickSwap smart contract:

0xdd0fDc648a9dbC9be5A735FE4561893a13399Da2

.

.

🔴 It is possible to buy and sell PGF7T tokens on Uniswap and QuickSwap Exchanges.

.

Price: PGF7T

.

.

.

.

Our NFTs

.

Enjoy the Journey 🚀

.

PGF500 Team

.