We used the CB Insights platform to track AI deals across all industries, from healthcare and cybersecurity to mobility and logistics.

.

Bloggin internal news

We used the CB Insights platform to track AI deals across all industries, from healthcare and cybersecurity to mobility and logistics.

.

I see hundreds of fundraising decks each year. I’ve been doing this for eight years now, so I’ve been able to see some longitudinal trends during that time.

There are a couple trends that I have noticed emerge over the last few years that I think have become industry standard. The problem is that I think they don’t work and need to be rethought. Not sure if this is going to be true for every investor out there, but this is definitely true for me.

Below are a couple things I’d change, and a proposed structure that I’d recommend for most fundraising decks. This is what I’d recommend for founders that are raising a more mature seed or series A that has at least early signs of Product/Market Fit.

https://bettereveryday.vc/rethinking-the-standard-fundraising-deck-406c9061e1c3

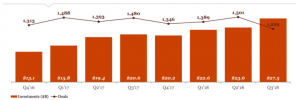

PwC and CB Insights‘ Q3 2018 MoneyTree report highlights the latest trends in venture capital funding globally.

Dollars were up 17% in Q3’18 as $27.5B was invested across 1,229 deals. Deal activity declined for the first time since Q4’17.

![]()

Often the opposite of disruption is the status quo.

If you’re a startup trying to disrupt an existing business you need to read The Fixer by Bradley Tusk and Regulatory Hacking by Evan Burfield. These two books, one by a practitioner, the other by an investor, are must-reads.

The Fixer is 1/3rd autobiography, 1/3rd case studies, and 1/3rd a “how-to” manual. Regulatory Hacking is closer to a “step-by-step” textbook with case studies.

Here’s why you need to read them.

One of the great things about teaching has been seeing the innovative, unique, groundbreaking and sometimes simply crazy ideas of my students. They use the Business Model (or Mission Model) Canvas to keep track of their key hypotheses and then rapidly test them by talking to customers and iterating their Minimal Viable Products. This allows them to quickly find product/market fit.

Except when they’re in a regulated market.

VC FUNDING / THU 4 OCT 2018

As most tech entrepreneurs will know, fundraising can help you secure market share, grow your business and build a killer product, but it can also be extremely daunting and time consuming.

According to UKTN’s Investment tracker, UK founded technology businesses raised more than £4bn in 2017, with the same data showing that companies in the space have already surpassed the £2bn mark so far this year.

Raising from the right investors, at the right time, on the right terms is key for business success. So, bearing in mind that companies are operating in an extremely competitive market, we partnered with professional services firm Smith & Williamson, to host a panel discussion in a bid to demystify what the fundraising process entails for both founders and investors.

https://www.uktech.news/guest-posts/funding/vc-funding/70652-20181004

Salvatore Minetti, CEO and founder, Prospex.ai on how to decide what type of funding is best for your tech business.

The UK has established itself as one of the best countries in the world to start and grow a business. In fact, between 2012 and 2017 approximately 3.5 million new companies were founded across Britain.

There are several reasons for this boom in entrepreneurialism, but financial support has proven demonstrably important. Specifically, a combination of private sector investment coupled with public sector initiatives have helped nurture an environment where early stage businesses can secure vital capital to enable them to grow.

Entrepreneurs in the UK are fortunate to have a plethora of places to turn when looking to secure finance for their fledgling company. Yet despite all these options – or perhaps because of the vast number of choices now available – the task of raising investment can be daunting for a startup.

https://www.uktech.news/news/70647-20181002

Selina Wang October 2, 2018

SoftBank Vision Fund is seeking to invest about $500 million in China’s Zuoyebang as it seeks a stake in the country’s vast online education market, people familiar with the matter said. The fund, created by SoftBank Group Corp., and Zuoyebang are still finalizing terms of the deal and the details could still change, the people said, asking not to be identified as the details are private. The education technology startup has already raised more than $500 million in funding from investors including Coatue Management, Goldman Sachs Group Inc., Sequoia Capital China and GGV Capital. Founded in 2014 by Chinese search giant Baidu Inc., Zuoyebang targets primary and secondary school students in China. The company, which was spun out from Baidu a year later, created a mobile app that lets students upload homework questions and search for answers. Zuoyebang has also expanded into live-streaming courses and one-on-one mentoring, with a reported 300 million registered users.

September 27, 2018

SoftBank Group Corp plans to create a new $100 billion fund every two to three years and spend $50 billion annually, its Chief Executive Masayoshi Son told Bloomberg Businessweek in an interview published on Thursday. Son has attracted more than $93 billion to his Vision Fund technology investment vehicle, and has flagged his intention to raise further financing. The comments reflect Son’s dealmaking ambitions that have shaken up the world of venture capital investing as he looks to accelerate his vision of a future driven by artificial intelligence. SoftBank did not immediately comment.