PGF500 Platform Corporate Video

Bloggin internal news

Dear Users,

Starting today, you can find PGF500 Platform back online!

If you registered on PGF500 Platform, for security reasons you will have to reset your password.

Payment with PGF7T Token is working and will be available at the end of the ICO, after April 30, 2019.

For more information about PGF7T you can connect to the web site https://etherscan.io

https://medium.com/@PGF500/pgf500-platform-is-back-online-e435e5b1b8b3

An analysis of emerging blockchain trends using the CB Insights NExTT framework.

https://www.cbinsights.com/research/report/blockchain-trends-2019/

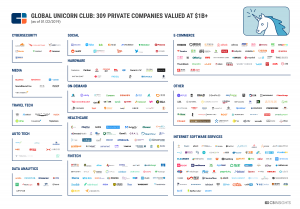

There are 309 private companies around the world valued at $1B+ as of 1/18/2019, all featured on our real-time unicorn tracker. These companies are collectively worth as much as $1,085B and have raised a combined total of nearly $261B.

Andrew Chen is a general partner at Andreessen Horowitz, a Silicon Valley venture capital firm, where he invests in new consumer startups.

Growing startups and evaluating startups share common skills

Earlier this year, I joined Andreessen Horowitz as a General Partner, where I focus on a broad spectrum of consumer startups: marketplaces, entertainment/media, and social platforms. This was a big moment for me, and the result of a long relationship that began a decade ago, when Horowitz Andreessen Angel Fund funded a (now defunct) startup I had co-founded. One of the reasons I’ve been excited about being a professional investor is the ability to apply my skills as an operator. The same skills needed to grow new products can be used both to evaluate new startups to invest in, and once we’ve invested; to help them grow.

https://andrewchen.co/investor-metrics-deck/

This is the first in our series on how to grow your startup from seed stage (where you have developed your prototype with some angel funding) to being worthy of a series A investment.

The market size or total addressable market (TAM) is very likely the first filter any VC will use to screen your startup. If the TAM is too small, then your startup is an easy pass.

But in reality, most consumer-focused startups we see in Asia have very large TAMs, and only few B2B startups are targeting markets that are too small.

Nevertheless, you need to be able to define and quantify your TAM when pitching for investment.

Early-stage investors like us always look for companies who are capable of returning at least 50x on an investment. If the average seed-stage company in Hong Kong or Singapore is valued at around US$5 million, then we would need to see a path for a company to achieve a US$250 million valuation.

https://www.techinasia.com/talk/validating-tam

The way to plan the future. Perfectly

This page contains all the useful information you need to start exploiting BUSINESS MODEL CANVAS potential and plan your way to success.

What is it?

BUSINESS MODEL CANVAS is a strategic business and lean management document, which has become an international standard to quickly visualise how a company or a startup creates, distributes and brings value to its customers.

This model was proposed by Alexander Osterwalder in 2004 in his first book “The business model ontology”. It was subsequently improved upon by the author, together with Yves Pigneur, Alan Smith and the collaboration of a community of 470 experts in 45 countries around the world.

For convenience, we have shortened the name to “business model canvas” or BUSINESS MODEL CANVAS. (Since there are only 4 BUSINESS MODEL CANVAS’s, I would remove this sentence and continue to use Business Model Canvas for SEO matters, even if we then have to check if these portions of text are really indexed or are part of non-public pages?)

Why use it?

BUSINESS MODEL CANVAS allows us to understand, summarise and share a lot of information in a simple way and in a language that everyone can understand.

It also gives us a global vision of the entire business system and its dynamics with the external market.

The power of this tool also lies in the visual and collaborative aspect that allows for different people to discuss (team work) and generate new ideas and solutions.

For startups, it is a strategic tool especially at events and bar camps.

When to use a BUSINESS MODEL CANVAS

Making a BUSINESS MODEL CANVAS is an operation that can be done at any time but it is very advisable when the following factors appear:

How do you use it?

The structure of a BUSINESS MODEL CANVAS resembles that of a table with 10 boxes. The latter can be completed and commented on by the appropriate editor and also by your collaborators.

The following list details the individual blocks of BUSINESS MODEL CANVAS:

Key Partner

Show all the companies (but also the NGO’s and cooperatives) with whom to start up a close collaboration in order to create value to offer your customers. Include in this list also: strategic alliances, suppliers and collaborators.

Key activities

Show a list of activities to be done to create value to offer your customers in three main areas: idea conception, production and promotion.

Value Proposition

The Value Proposition represents the heart of every company or startup and is a key activity to create value to offer your customers. We advise you to carry out the activity by choosing the ideas on a list and ranking them by answering the following questions:

Tips from Michael Hendricks

Creating an adequate Value Proposition is a fundamental step, which is why we contacted Michael Hendricks, CEO of Uncompress, the Californian company that has created a revolutionary compression engine:

“The only way to get to your customers is to analyse the market segment and collect the value propositions of your competitors so as to understand how your company can solve a user problem that no one has answered yet.

Once you have identified the value, immediately share it with your colleagues and make a very rough prototype to try with friends and relatives to see if the idea works”

Customer Relations

Describe how you plan to acquire and retain customers.

These are our tips for building solid relations:

Customer Segments

Separate customers into groups defined by needs, interests, relation types and distribution channels.

Donald Nielsen, Head of the Google Mobile User Experience, has some tips for you:

“To fully understand the needs of the users you want to contact, the only advice is to start with an exploratory phase, in which, together with your collaborators, you perform 5-8 interviews to analyse the previous experience of people in the area that you wish to perform. Next, analyse the video or audio of the interview and compare it with the notes collected to create a sort of identikit of your typical customer, which we call a persona . The latter is a very powerful tool because it helps you give a face to your customers through real needs and frustrations”.

Key Resources

List what the company or startup needs in order to produce the value to offer the customer. Resources can be physical, human, cultural, digital and financial. Remember to rank this list in relation to the value offered.

Channels

Imagine the means by which the value offered reaches your customers in the communication, sales and distribution phases.

Jack Blackfield of Nutshell, a successful startup for the creation of Smartwatch, recommends you do the following:

Cost Structure

Enter the list of fixed and variable costs that the company or the startup will face to create the value. Software tips: we suggest you use the Editor table tool and use the global cost view, by selecting the tables and generating a chart from the toolbar.

Revenue Streams

After the cost list, remember to include the revenue from the different types of customers, divided by category of value offered. We also recommend you to:

We have added a block to the business model canvas called Brainstorming Stage that you can use as a container to collect ideas, suggestions or personal or company team notes.

Here are some examples: marketplace model, free model, freemium model, subscription model, on-demand model, experience model, hypermarket model, ecosystem model, pyramid model, access-over ownership model.

https://www.pgf500.com/tutorial

A. Osterwalder, Y. Pigneur, G. Bernarda, A. Smith (2014). Value Proposition Design.

2018 is shaping up to be one of the biggest years ever for venture capital, with over US$84 billion already invested with a full quarter yet to go. News reports of US$100 million venture rounds are seemingly commonplace.

Yet, data indicates that a large percentage of early-stage startups raising money this year will ultimately fail. And most of the remaining ones will pivot in order to survive and hopefully thrive.

This begs the question: What exactly are investors and lenders looking at when determining which companies are “financeable?”

https://www.techinasia.com/talk/3-metrics-evaluating-early-stage-saas-startups