FOMC

.

—–

Bloggin internal news

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Vertical overview |

3 |

Q3 2021–Q2 2022 timeline |

6 |

Carbon & emissions tech landscape |

7 |

Carbon & emissions tech VC ecosystem market map |

8 |

VC activity |

10 |

Segment overview |

12 |

Carbon tech |

13 |

Green industry |

20 |

Built environment |

28 |

Land use |

34 |

.

Q2/2022 Carbon emission tech launch Report

—–

.

.

.

———

.

.

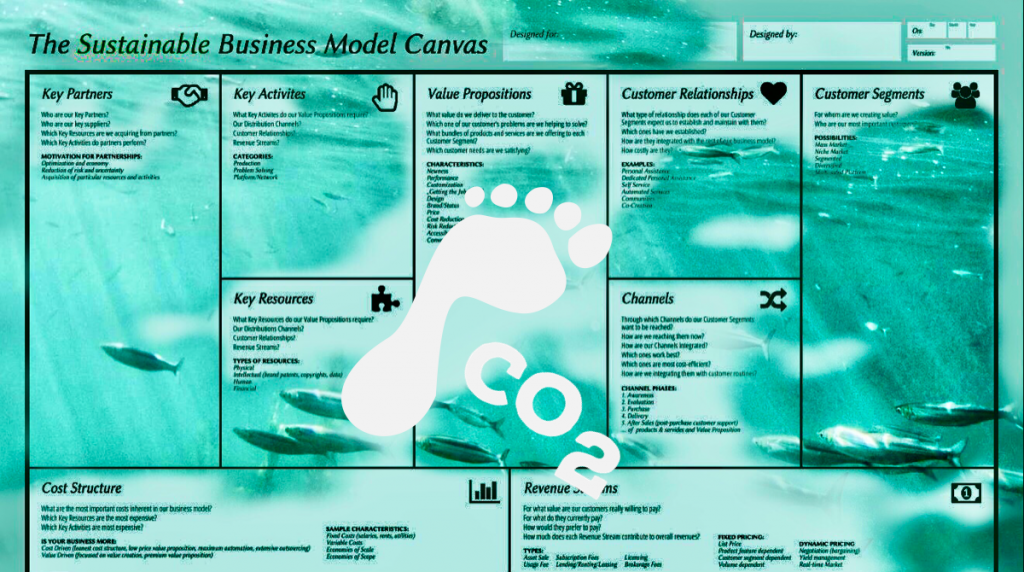

Sustainable Business Model Canvas

.

Sustainable Business Model Canvas – Video

.

——

.

.

.

.

.

.

.

.

.

.

—-

.

.

.

—–