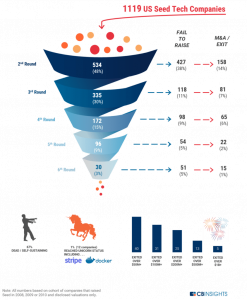

The Venture Capital Funnel Shows Odds Of Becoming A Unicorn Are About 1%

The venture capital funnel highlights the natural selection inherent in the venture capital process.

We followed a cohort of over 1,100 startups from the moment they raised their first seed investment to see what happens to them empirically.

So, once you take your first bit of seed funding, what can startup founders expect? The data bears out the conventional wisdom: nearly 67% of startups stall at some point in the VC process and fail to exit or raise follow-on funding.

In our latest analysis, we tracked over 1,100 tech companies that raised seed rounds in the US in 2008-2010. Less than half, or 48%, managed to raise a second round of funding. Every round sees fewer companies advance toward new infusions of capital and (hopefully) larger outcomes. Only 15% of our companies went on to raise a fourth round of funding, which typically corresponds to a Series C round.

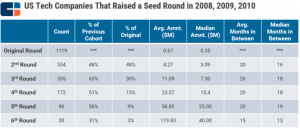

The data below gives a more detailed look at the outcomes.

What we found:

- There was a 2 percentage point increase from 46% to 48% in companies raising a first follow-on round in our updated analysis.

- 30% of seed funded companies exited through an IPO or M&A, up by 2 percentage points from last year.

- 67% of companies end up either dead, or become self-sustaining (maybe great for the company but not so great for investors). This was a 3 percentage point decrease since our last analysis. It is hard to know the exact breakdown for these companies as funding announcements get a significant amount of fanfare but cash flow positivity or profitability does not. Also, some companies stumble on as zombie companies for years before calling it quits. Not to mention, the death of companies generally happens without any official announcement, i.e. there is no such thing as a “startup death certificate” (although increasingly, startups are willing to share their failure post-mortems).

- Not surprisingly the odds of becoming a unicorn remained low in our new analysis, hovering around 1% (1.07%), with 12 companies reaching that status. Some of these companies are the most-hyped tech companies of the decade, including Uber, Airbnb, Slack, Stripe, and Docker.

- 13 companies exited for over $500M, including leading companies within their categories like Instagram, Zendesk, and Twilio.

Some other metrics:

- While almost half (48%) of companies raise their first follow-on round, more than half (63%) of these companies went on to raise their second follow-on round which tends to be at the Series B stage. It is much easier to raise a Series B round, than a Series A round.

- Average time to raise between months stayed fairly consistent across all the rounds, at about 20 months. At the 6th round the time to raise a follow on drops off by about 5 months, which is a small cohort of later-stage companies, but it shows that investors are a lot more eager to invest at this point.

- The median seed disclosed deal size was $350K while the average was $670K, and the gap between median and average round sizes tends to increase over time, showing that mega-rounds in later stages skew the average upward. By the sixth follow-on round, the median round amount was $40M but the average was $120M.

Methodology:

- This analysis contains a cohort of tech companies headquartered in the US that raised their first round of seed funding either in 2008, 2009, or 2010 and follows them through to August 31, 2018. Given the date range, these companies have had a substantial amount of time to obtain follow-on funding and exit.

- Tranches are not counted as follow-on rounds, only equity rounds are counted as follow ons.

- Of note, seed deals were on the whole less prominent in 2008-2010 than they are now. They’ve risen in popularity in the last few years with the explosion of micro VCs and the greater frequency of seed deals by multi-stage funds. If we were to repeat this analysis a few years from now, the numbers could look very different and there would likely even be a smaller proportion of companies obtaining Series A and Series B funding.

……

https://www.cbinsights.com/research/venture-capital-funnel-2/?utm_source=CB+Insights+Newsletter&utm_campaign=049fba35a6-ThursNL_09_06_2018&utm_medium=email&utm_term=0_9dc0513989-049fba35a6-87406845