PwC and CB Insights‘ Q3 2018 MoneyTree report highlights the latest trends in venture capital funding globally.

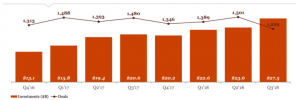

US FUNDING INCREASES, DEAL ACTIVITY DECLINES, IN Q3’18

Dollars were up 17% in Q3’18 as $27.5B was invested across 1,229 deals. Deal activity declined for the first time since Q4’17.

![]()

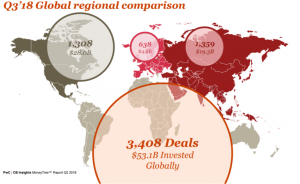

GLOBAL FUNDING INCREASED SLIGHTLY IN Q3’18, WITH DEALS DECLINING

.

NORTH AMERICA AND ASIA DOMINATE IN THE NUMBER OF NEW UNICORNS

https://www.cbinsights.com/research/report/venture-capital-q3-2018/?utm_source=CB+Insights+Newsletter&utm_campaign=fcd1d83ff6-TuesNL_10_09_2018&utm_medium=email&utm_term=0_9dc0513989-fcd1d83ff6-87406845