How to improve your business strategy with pgf500 platform

.

The first step is to photograph the current business strategy.

.

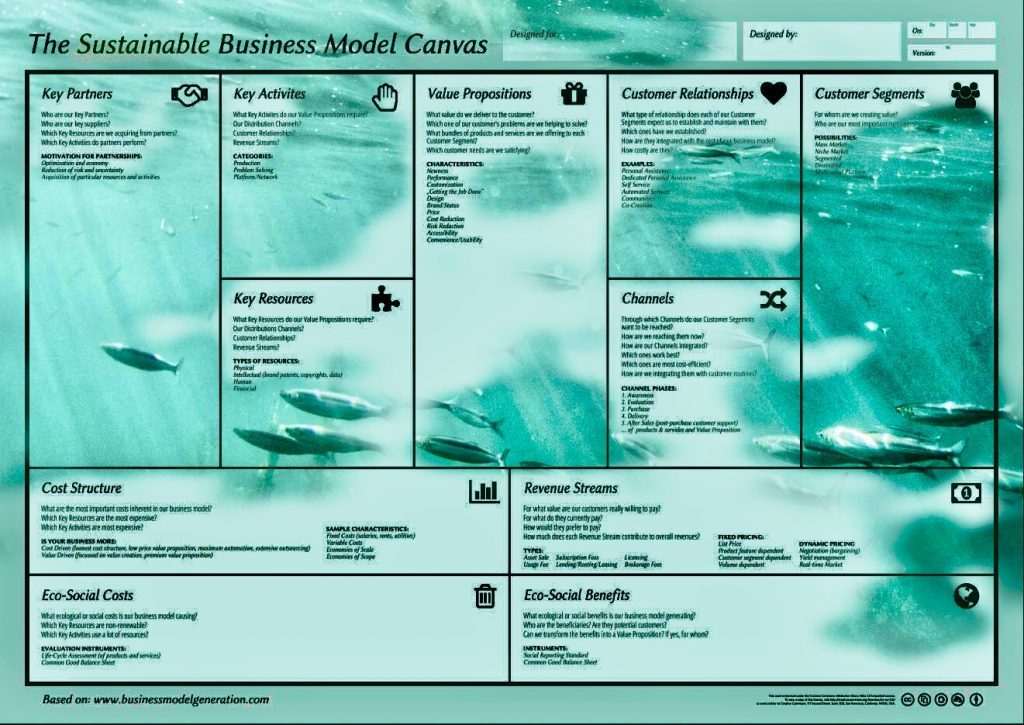

To do this, the best tool is to use a model called a Sustainable Business Model Canvas.

.

So you can use pgf500 platform, open your own project, and enter all your info in the Sustainable Business Model Canvas.

.

.

Once this is done, since you have 15 days of free trial, you can create a pivot of your project and invite your team to the second project, simply by entering their emails in “Team”.

.

At this point you and your team can work on the new strategy, a new business model, experimenting with new actions and seizing new opportunities.

.

Remember that all the information in the 11 fields of the Sustainable Business Model Canvas is important.

.

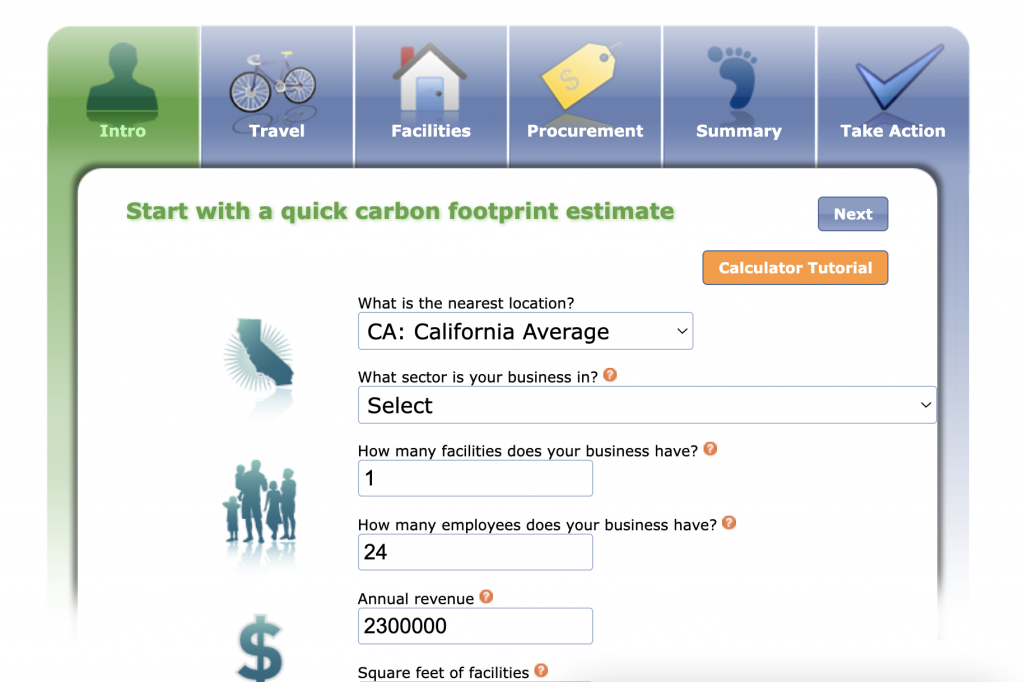

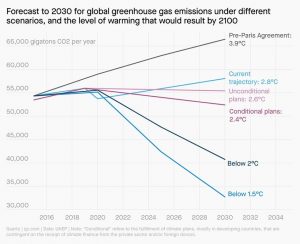

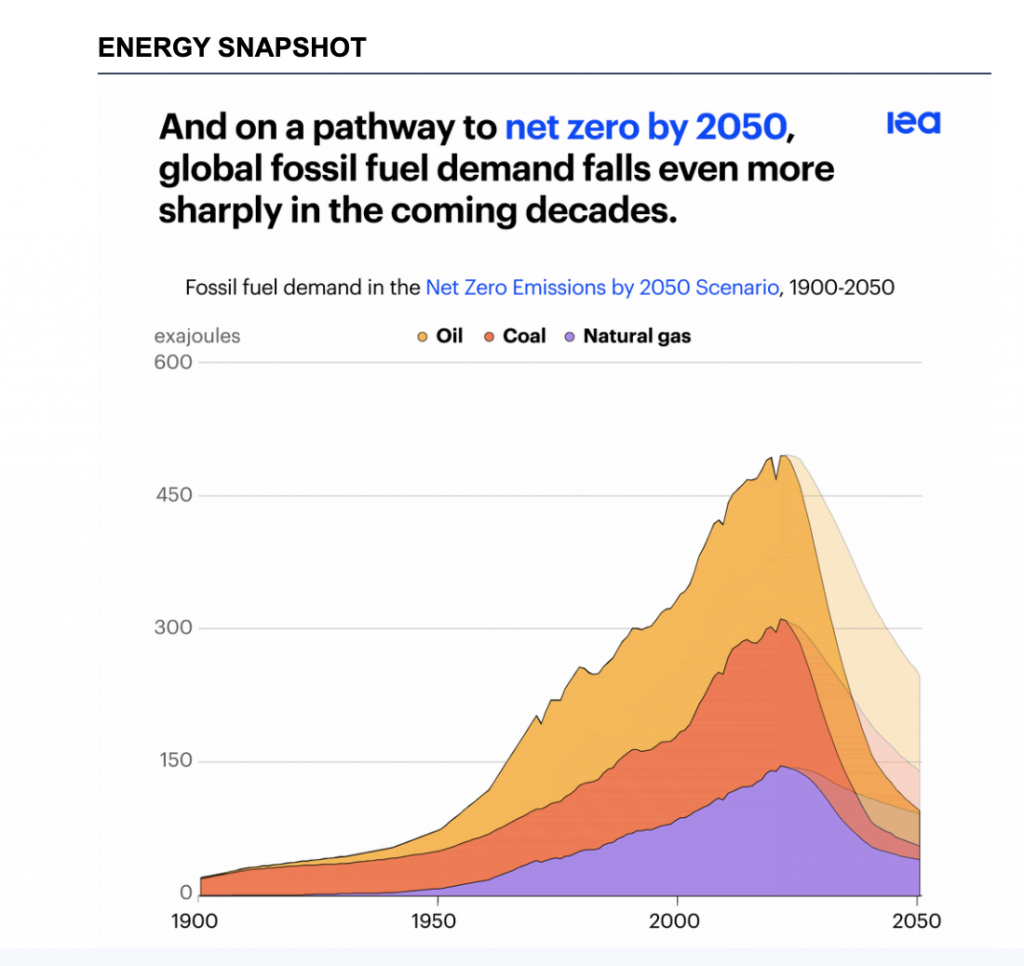

In addition, you can also turn your business green, in order to become sustainable and carbon-neutral, Net Zero.

.

.

.

If you want to better understand what a business model is, find some insights at these links:

.

Business Model Canvas

.

Sustainable Business Model Canvas

.

Start with 15 Days For Free

.

.

.

pgf500 Team

.

—-