How Web3 could help tackle climate change using regenerative finance – or ‘ReFi’

.

-

The global fight against climate change is above all a coordination problem, with investment and policies not being allocated in the most efficient way possible.

-

Decentralized Web3 technologies could improve coordination around tackling climate change because they use local knowledge and actors to guide policies and put funding where it’s needed.

-

The World Economic Forum has launched the Crypto Sustainability Coalition, dedicated to spotlighting real-life use cases for Web3 technologies.

.

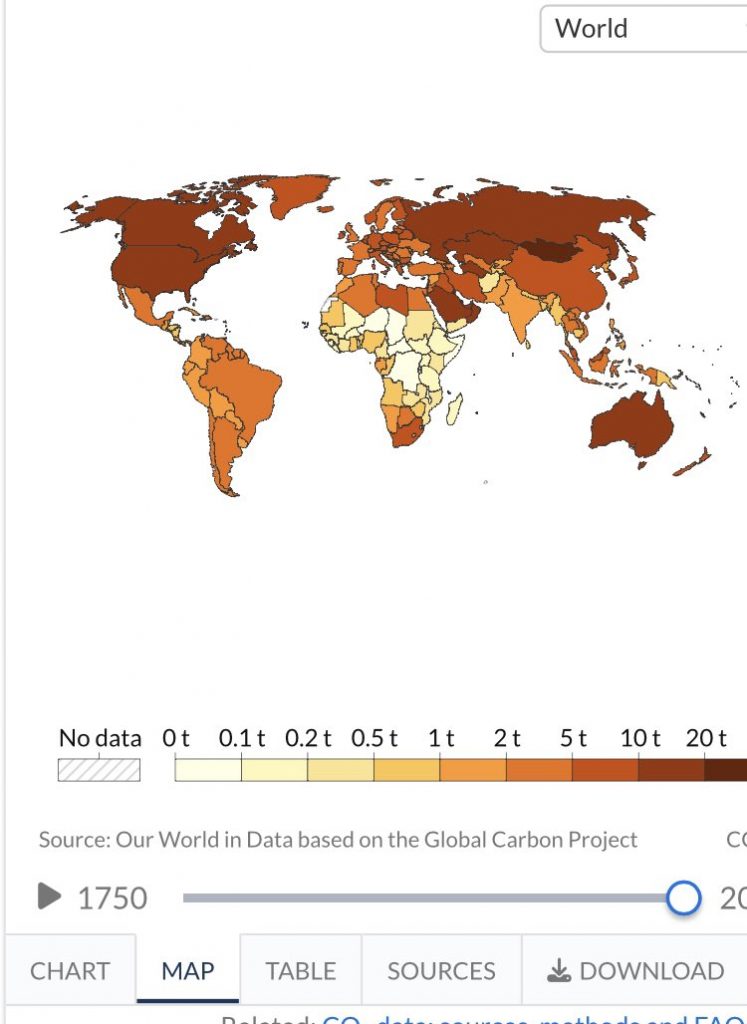

Climate change is a global coordination problem. The system has failed to coordinate effective policies and capital investment into the commitments necessary to address the most pressing threat to humanity.

To avoid greater loss of life, biodiversity and infrastructure, accelerated action and ambitious climate policies are required to adapt to climate change and rapidly reduce emissions.

So far, progress on adaptation is uneven and the chasm between action taken and what is needed to manage the risks is growing. There are several reasons for this: concerns about the compatibility of decarbonization with economic development, the fairness of global burden sharing on climate mitigation and the risks of competitive disadvantage in both domestic and international markets — to name but a few.

Global coordination technologies that can transcend the mass bureaucratization of climate action are urgently needed. This is where Web3 innovation could help.

.

Regenerative Finance

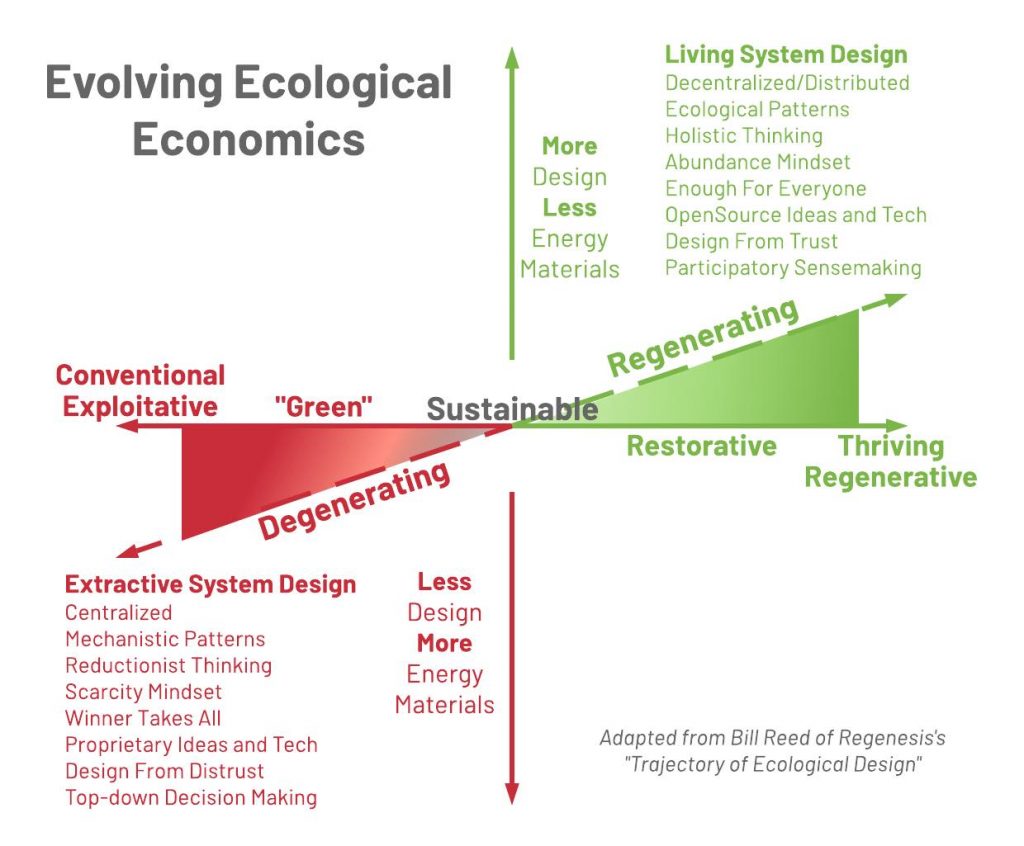

Web3, a new iteration of the internet that harnesses blockchain to “decentralize” management, has positioned itself at the heart of the regenerative finance movement, or “ReFi” — a new economic paradigm that operates at the intersection of climate action and Web3 communities.

ReFi is anchored in decentralized finance, or DeFi, and the theory of regenerative economics. DeFi refers to an alternative financial system focused on the democratization of financial goods and services. Regenerative economics focuses on the creation of systems that restore and preserve the physical resources essential for planetary well-being.

Today, ReFi is a call to action, galvanized by the need to address both the failure of traditional markets to account for the negative externalities of carbon emissions, and the inefficient allocation of resources. This is also a call to action for policymakers to provide legislative direction and support for Web3 innovation in applications as an impetus to positive environmental and social outcomes for all, not just the privileged few. Progress on this latter front is making some headway.

Recently, The White House Office of Science and Technology Policy (OSTP) released its long-anticipated report on Climate and Energy Implications of Crypto-Assets in the United States which provided a balanced and nuanced purview into the Administration’s climate priorities, as it relates to the potential of digital assets. President Biden’s Executive Order explicitly stated the nation’s interest in responsible financial innovation, and since then has reiterated the criticality of a discussion of the potential uses of blockchain that could support technologies for monitoring or mitigating climate impacts.

The emergence of Web3 technology, values and ideas inherent to the ReFi movement can mobilize capital to fund the climate crisis solutions currently being researched by the OSTP, and within the time and at the scale required for the United States to fulfill the Paris Climate Accord’s global commitments. As greater interest and research, as well as robust policy, is invested into the ReFi space, the more effective the incentive for individuals and businesses to take care of the planet.

.

Using Web3 tech to reverse ecosystem degeneration

Among the most pressing challenges that Web3 could address are deforestation, land degradation and desertification — life-threatening issues causing food insecurity, biodiversity loss, forced displacement of local communities and the acceleration of climate change.

The planet loses upwards of 80,000 acres of tropical rainforest every day — that is the equivalent of approximately 60,000 football fields a day. This impacts endangered species and climate-vulnerable geographies more severely than others. Africa is particularly vulnerable to land degradation and desertification. Desertification affects around 45% of Africa’s land area, with 55% of this area at a high or very high risk of further degradation.

Similarly, indigenous people are also impacted by the degradation of our land, soil and water. And despite there being about 500 million pastoralists in the world, they are often excluded from the land restoration agenda pulled together by mainly those privileged with the resources to adapt to climate change. Indigenous peoples have no alternative resources. Their resource is the land itself.

….

….

The Crypto Sustainability Coalition

The ReFi movement has provided a space for innovators, creatives and advocates to reconceptualize climate action at a pace uninhibited by the bureaucracy and politicization rampant across legacy sustainability systems. Web3 climate tools and services share values inherent to ReFi and are foundational to the scale of global coordination needed to tackle climate change. These values include building cooperatives, democratic ownership within communities, optimizing community benefit, creative sustainability, radical inclusion, non-extraction and intentional restoration.

The World Economic Forum has formed a new initiative — the Crypto Sustainability Coalition — dedicated to these values and aimed at facilitating a balanced, research-driven narrative shift that spotlights the positive externalities and real-life use cases that abound the ReFi space.

The Crypto Sustainability Coalition is focused on how to leverage blockchain tools to achieve positive climate action. The Forum is collaborating with a multi-stakeholder community of purpose to bridge the gap between traditional and emerging sustainability systems, as well as demonstrate evidence-based thought leadership in a multi-chain Web3 world.

..

Web3 tech can be used to fight climate change

.

—-

.

.