As a kid, most of us were attached to our favorite stuffed animal, blanket or another inanimate object. We’d carry it wherever we went. So much so, that it became part of our then identity.

Throughout our lives, our physical possessions become associated with our identity. You might be known for your collection of Marvel Cinematic Universe DVDs or baseball cards. You can prove they’re yours and take them with you wherever you go.

But, this isn’t the case in today’s internet because you don’t technically own any of your digital assets.

In Web2, true ownership does not exist, only leased ownership.

.

What is a Digital Asset?

.

To put simply, a digital asset is content that is stored electronically. So images, audio, videos, word documents, e-books, in-game items, domain names, or someone’s account can be considered digital assets.

The real question is: who owns these digital assets?

Answer: Not yours. It’s the platforms that you use.

Ownership in Web2 is a Myth

In Aaron Perzanowski and Chris Hoofnagle’s study, “What We Buy When We Buy Now”, they found that 83% of people think they own digital goods in the same way they own physical ones – free to do as they please with it. Free to lend it, sell it, or give it away.

But the truth is, you don’t own any of your digital assets.

.

There are two reasons ownership is a myth in Web2.

1. You borrow digital products on the internet.

When you lease an apartment, it’s clear that you don’t own the apartment. So you know that it cannot be sold to another person. Similarly, when you have a subscription to a platform like a streaming service, you understand that you don’t own any of the movies or tv shows.

But, what about when you buy digital products?

If you ever “buy” a song from iTunes music, an e-book from Amazon, or a movie from the Microsoft Store, you don’t actually own them. You just purchase a license to access them. One that is revocable by the company at any moment or permanently lost if your account is deleted.

The “buy” button for digital products is deceptive.

When you create a social media account like Instagram, you borrow the right to use the account in exchange for all your data. Do you remember when Facebook renamed itself “Meta? News stories discussed how Thea-Mai Baumann, an Australian artist and technologist, had the Instagram handle @Metaverse. On November 2nd, 2021, it was disabled around the same time Facebook rebranded. This was a decade of her life’s work that disappeared. Luckily, she got her account back, but this isn’t always the case.

Although most of your accounts online are free, you end up paying by giving up your data.

That’s not right.

You don’t own the digital assets you “buy” nor own the “free” ones either.

True ownership means that your digital assets are not at the whims of the platforms.

.

2. You cannot transfer ownership.

When you own the Marvel Cinematic Universe DVDs, you can decide to switch to becoming a DC fan and sell or give away your MCU collection to someone. You have the power to transfer ownership to them.

You can’t do that in Web2.

When you buy an ebook on the Kindle, your book is bound by both the platform, Amazon, and your account. You buy the license to use it and don’t even know. It’s because Web2 companies want consumers to stay attached to their platform within their walled garden to maximize profit. So if you finish reading the ebook, you can’t let your friend have it unless they have access to your account.

Like in the real world, you should have the power to transfer ownership as you see fit!

.

Here’s a simple formula for ownership of your digital assets.

True Ownership = Proof of Ownership + Transferability of Ownership

.

Web3 unlocks this formula for you.

Web3 Enables True Ownership of Digital Assets

We are living in the Digital Industrial Revolution.

.

In Web2, the commercial goals of the largest internet platforms are at odds with their most essential contributors — their users.

.

We can envision a world where ownership of the internet is distributed. Ownership in Web3 means that the contributors— builders, operators, and users— own a piece of what they use.

Thanks to Web3, digital assets are recorded on the blockchain, so you can prove ownership. Also, you can transfer ownership of digital assets to someone else through secondary marketplaces or direct exchanges.

Since you can prove ownership and transfer that ownership, you gain true ownership of your digital assets in the next iteration of the internet.

.

There are three digital assets that are currently revolutionizing ownership online.

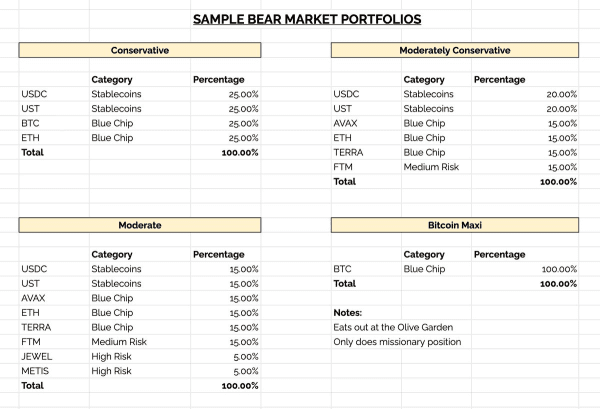

1. Cryptocurrencies and Tokens

A cryptocurrency is a digitally-native currency that is secured by cryptography and operates on the blockchain, which makes it impossible to counterfeit or double-spend. Because cryptocurrencies are built on blockchain technology, there is a distributed ledger across disparate networks of computers that keeps up with each transaction.

Cryptocurrency can feel like a vague term. So let’s clarify.

A cryptocurrency is the native asset of a given blockchain. For example, some popular blockchains are Bitcoin, Ethereum, Cardano, and Avalanche, and their native assets (cryptocurrencies) are Bitcoin, ETH, ADA, and AVAX, respectively.

The distributed ledger allows you to prove ownership of your cryptocurrency (e.g. ETH) on the blockchain (Ethereum).

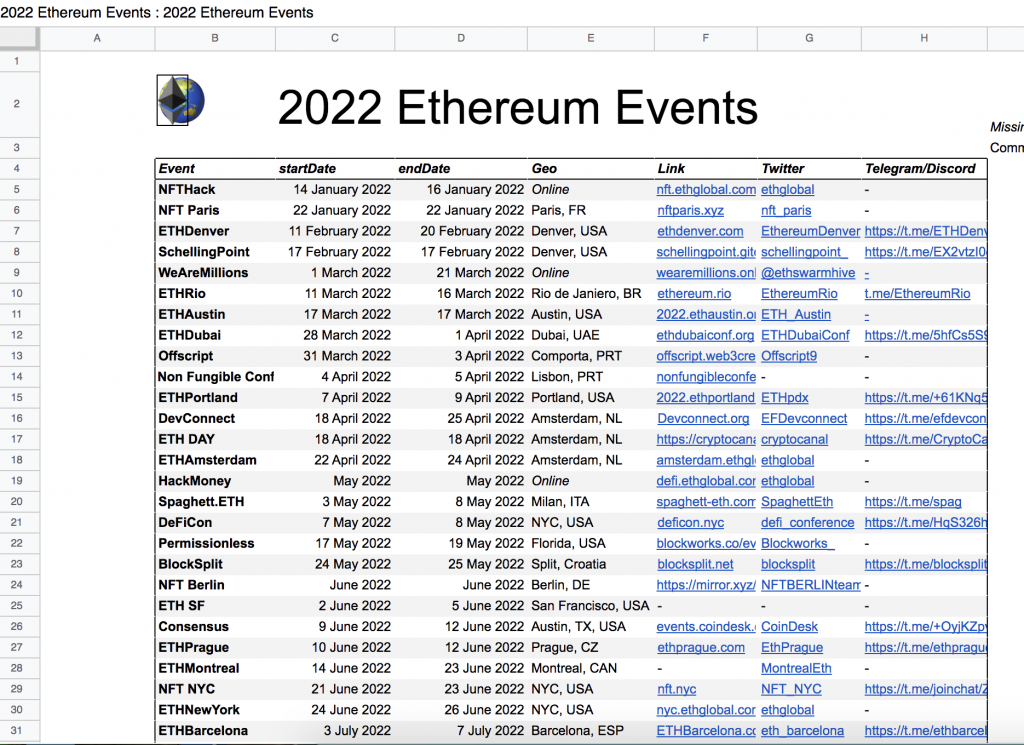

There are numerous ways to participate in any blockchain. You can be part of an NFT project, fund a Decentralized Autonomous Organization (DAO), or use decentralized applications (or dApps).

Most NFT projects, DAOs, and dApps have their own native token, which can be used to interact with them. For example, Bored Ape Yacht Club is an NFT project based on the Ethereum blockchain. The project team created a native token called ApeCoin, which was given to the NFT holders, ultimately transforming into a DAO. ApeCoin is a token used as both a governance token to vote on the direction of the project and used as a utility in its future ecosystem.

Since ApeCoin is a token on the Ethereum blockchain, you can:

-

Prove ownership on the Ethereum blockchain

-

Transfer ownership of the token by buying, selling or gifting.

The contributors become owners in Web3.

.

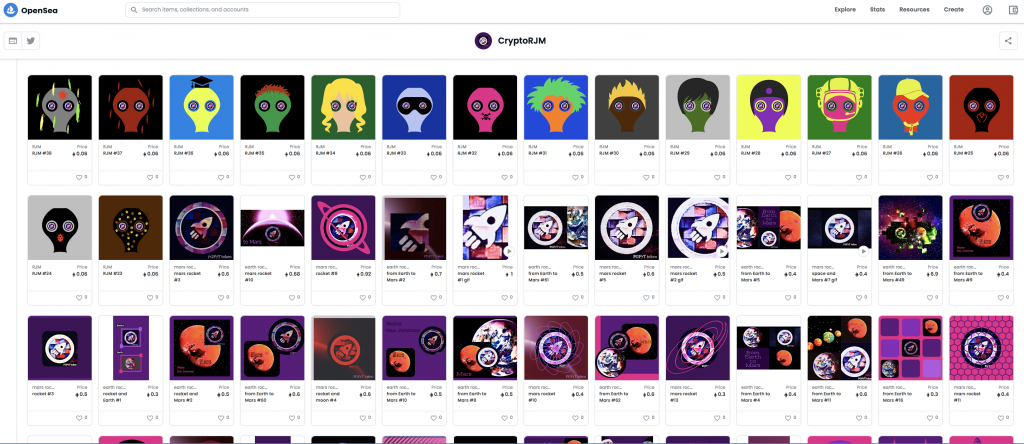

2. Non-Fungible Tokens or NFTs

NFTs are one-of-a-kind, verifiable digital assets on the blockchain. It can’t be replaced with something else.

The use cases for NFTs are endless.

NFTs make it possible for gamers to own in-game items, have real estate in a metaverse, contribute to their favorite artists and much more!

Imagine if Stan Lee made the Marvel comic books into NFTs when he and the team started. You could read the comic books and have ownership early in its conception. Or, what if you listened to your favorite artists before they went mainstream. If they released their songs or album as an NFT, you could not only own the digital album, but prove you were a fan before everyone else was.

NFTs unlock the ability for true ownership of digital goods.

NFTs are an evolutionary step toward Web3 adoption as content online is increasingly created, operated, and owned by the users.

.

3. NFT Domains

In the future, internet users will own digital property.

Matt Gould, Co-Founder and CEO of Unstoppable Domains states, “There is going to be a massive development around the amount of property and around the amount of stuff people own online over the next few decades.”

The Unstoppable Team believes your digital assets should be associated with your digital identity. But, in Web2, application silos make it impossible to own your holistic digital identity.

Domains in Web2 could have been a solution, but even domain names became a prime example of leased ownership. For example, the Top Level Domain (or TLD), .com, is owned by VeriSign. When you “buy” a .com domain name, you pay a registrar like GoDaddy. That registrar pays VeriSign to register your domain. After that, you must register and pay on a yearly basis.

A domain name should be your digital property that you own, not something you rent.

In Web3, it’s possible.

Say hello to NFT Domains.

At their simplest form, NFT domains are a digital name (example: Matt.nft) that exist as NFTs on the blockchain. They are unique to you and are stored in your wallet to provide special benefits that go far beyond traditional domains. It is a name to login everywhere you go. A name to pay and get paid with. A name to prove ownership of your data and digital assets.

.

Everything You Need to Know About Digital Asset Ownership in Web3

.

——