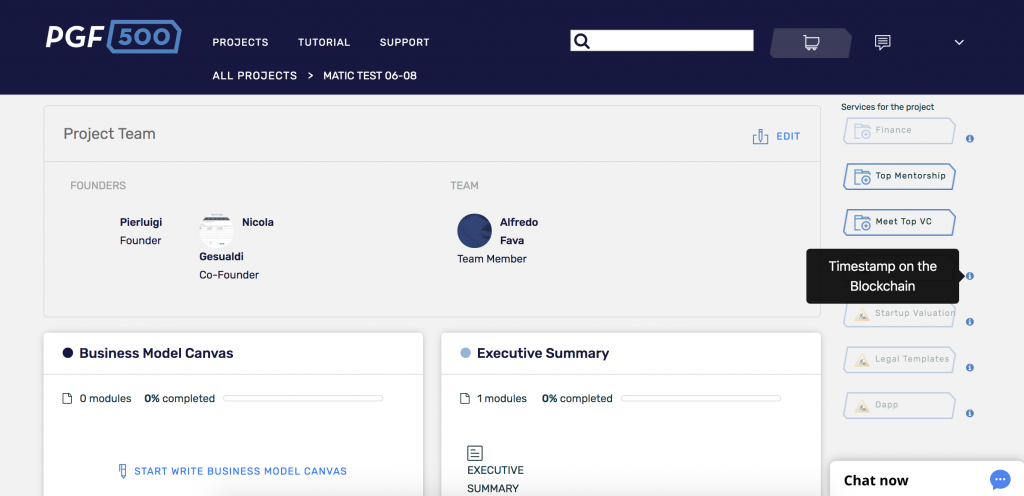

New service bar (on the right) and 2 services already available:

1. Top Mentorship

2. Meet Top VC

Enjoy

-The PGF500 Team

Bloggin internal news

New service bar (on the right) and 2 services already available:

1. Top Mentorship

2. Meet Top VC

Enjoy

-The PGF500 Team

New services for Startups will be available soon:

• Top Mentorship (PGF7T only)

• Meet Top Venture Capital (PGF7T only)

• Startups Valuation

• Legal Templates

• Timestamp on the Blockchain (PGF7T only)

• Dapp, an exceptional business innovation available to millions of users (PGF7T reward)

.

.

PGF500 Team

Emerging Disruptors

www.pgf500.com

🚀🚀🚀

~~~

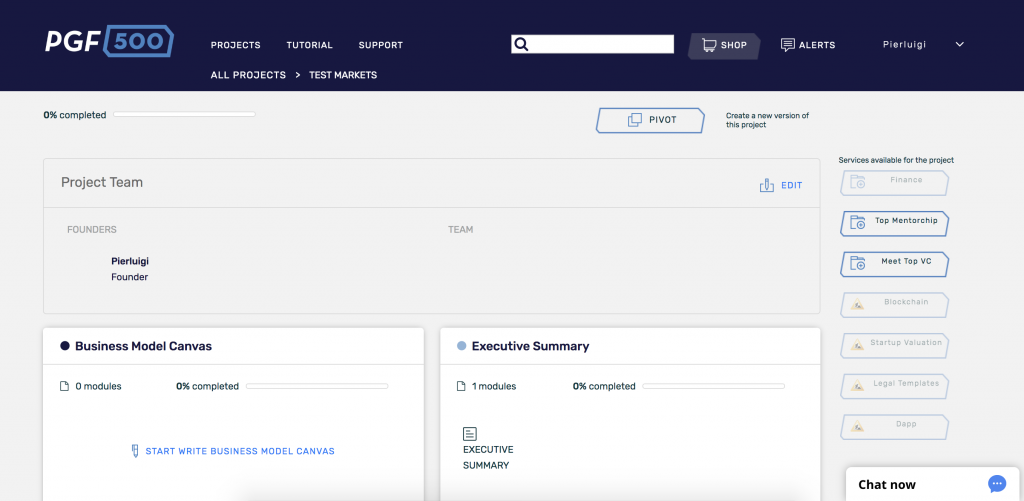

PGF500 News:

Within about a month PGF500 Platform users will be able to use new strategic Startups services with payment only in PGF7T token worth €50k and €100k.

PGF500 Team

Emerging Disruptors

🚀🚀🚀

An analysis of emerging blockchain trends using the CB Insights NExTT framework.

https://www.cbinsights.com/research/report/blockchain-trends-2019/

This is the first in our series on how to grow your startup from seed stage (where you have developed your prototype with some angel funding) to being worthy of a series A investment.

The market size or total addressable market (TAM) is very likely the first filter any VC will use to screen your startup. If the TAM is too small, then your startup is an easy pass.

But in reality, most consumer-focused startups we see in Asia have very large TAMs, and only few B2B startups are targeting markets that are too small.

Nevertheless, you need to be able to define and quantify your TAM when pitching for investment.

Early-stage investors like us always look for companies who are capable of returning at least 50x on an investment. If the average seed-stage company in Hong Kong or Singapore is valued at around US$5 million, then we would need to see a path for a company to achieve a US$250 million valuation.

https://www.techinasia.com/talk/validating-tam

I’ve been thinking why the ethical boundaries of todays founder/VC interactions feel so different then they did when I was an entrepreneur. I’ve written about the root causes in an HBR article here and an expanded version here. Worth a read.

Link:

Produced by Forbes in partnership with TrueBridge Capital Partners, the Next Billion Dollar Startups List recognizes 25 of the fastest-growing companies in tech and provides insight into the industries they are transforming. While last year’s list was highly concentrated in five industries, this year, the high-growth startups on our list are more diverse than ever.

Among the sectors represented by this year’s list are insurance (Lemonade), payments (Flywire), security (Anduril Industries, Auth0), hospitality and travel (Sonder, Away), and many more. Here are the three industries and their sub-sectors that have the greatest concentration of startups on their way to billion-dollar valuations.

Consumer Products & Technology

With the traditional retail industry in ongoing crisis, the internet has become a refuge for many fashion brands. According to CB Insights, competition in the fashion space has been increasing, especially with the rise of online-first brands using technology to transform their businesses and the industry.

To achieve your aggressive growth goals in the face of uncertainty and change, you need to follow a new set of rules that are completely counterintuitive to accepted “best practices” of either early stage startups or classic corporate management.

Read the full post on Medium.

Here’s a view of what a decentralized, all-code company might look like in its initial form.

As tech giants like Facebook explore blockchain as a means to reinvent themselves, startups are working on blockchain projects that could displace services like AWS (as with Filecoin) or loosen tech companies’ hold on personal information.

Now, in addition to transforming areas like data and payments, blockchain is shaking up traditional corporate structures. Through blockchain, companies could fundraise without stocks, operate without bank accounts, or pay employees without even knowing their names.

Could we soon see the creation of a completely ownerless company?

Below, we dig into how the blockchain-based company of tomorrow might take shape, from anonymous workforces to shared physical assets.

Conventional wisdom dictates that startups should incorporate with taxes and stock options in mind. However, tomorrow’s companies might abandon this philosophy altogether.

According to Earn founder-turned-Coinbase exec Balaji Srinivasan,

“Blockchain companies, to build a community, only need an internet connection and a good regulatory environment… They’re open source groups that [manage internal funds in] straight crypto and might not even have traditional, terrestrial bank accounts.”