.

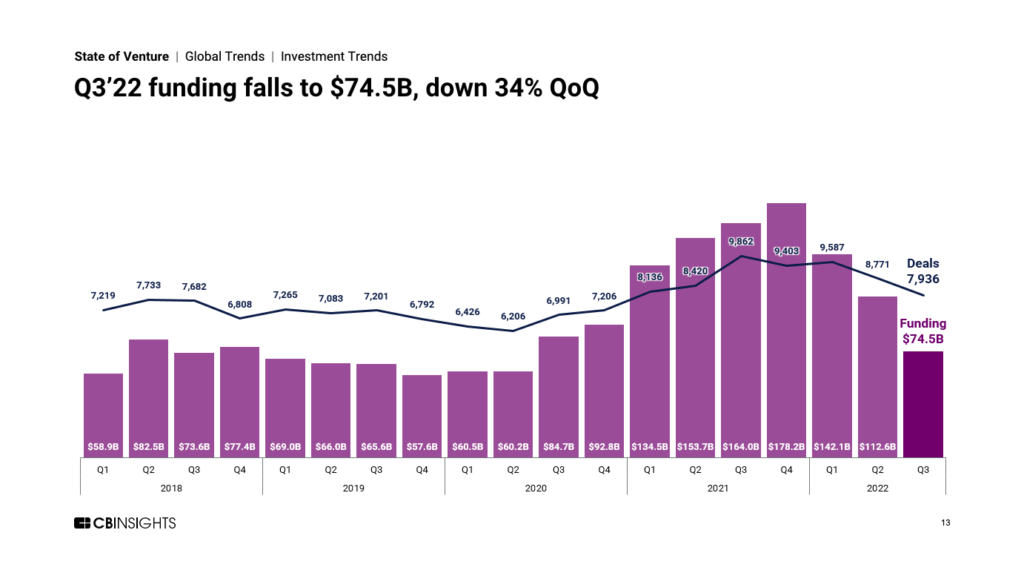

The global venture ecosystem continues its slowdown in Q3’22 as funding decreases 34% quarter-over-quarter.

.

Global venture funding reached $74.5B in Q3’22, hitting a 9-quarter low. The new funding level represented a 34% drop quarter-over-quarter — the largest quarterly percentage drop in a decade — and a 58% decline from the investment highs reached in Q4’21.

Deal activity hit 7,936 deals total, marking a 9.5% quarterly drop and a 7-quarter low.

.

US-based companies raised $36.7B, accounting for just under half of global Q3’22 funding. Some of the quarter’s largest rounds in the region went to companies including TeraWatt Infrastructure, TerraPower, and EnergyX.

Other Q3’22 highlights across the venture ecosystem include:

-

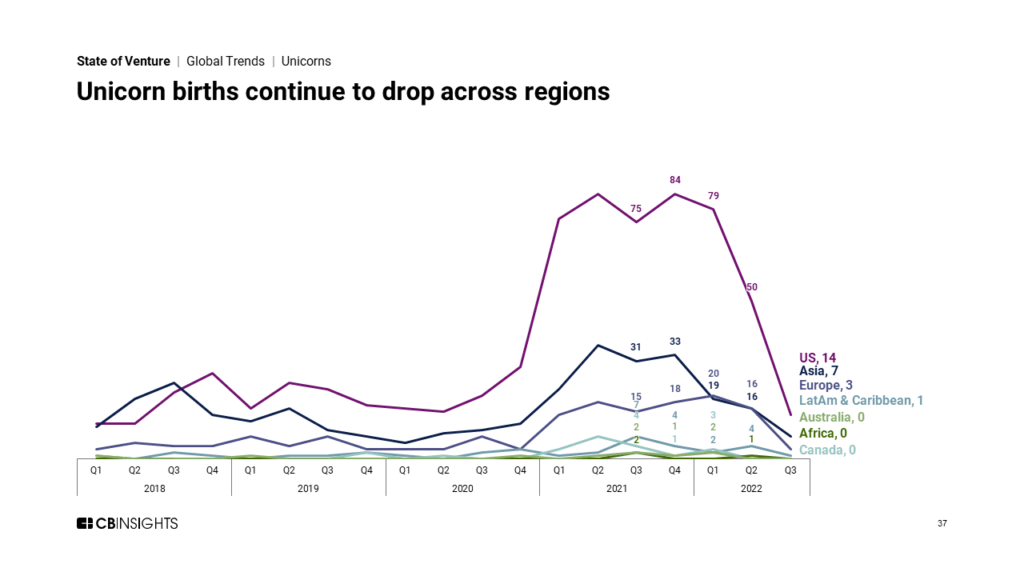

Q3’22 saw only 25 new unicorns (private companies valued at $1B+) — the lowest unicorn birth count since Q1’20. The US accounted for the majority (14) of these births. Leading entrants include Zhiji Auto ($4.4B valuation), Tridge ($2.7B), and 21.co ($2B).

-

100M+ mega-rounds collectively accounted for $29.6B in Q3’22, marking a 9-quarter low and a 44% drop QoQ. Mega-round deal count dropped in all major regions to hit 144 in Q3’22, also a 9-quarter low.

-

Retail tech funding declined 33% QoQ to $8.5B, even as deals ticked up 5% to 776. Average deal size YTD clocked in at $24M, down 35% compared to 2021 averages.

-

The fintech sector also continued to contract. With $12.9B raised across 1,160 deals, Q3’22 was the weakest quarter the sector has seen since Q4’20.

-

Global digital health deals fell to their lowest levels in 5 years, with $5B raised across just 419 deals. The US led, accounting for more than half (58%) of total digital health funding at $2.9B.

.

.

State of Venture Q3 2022 Report

.

—–

.

.