The death of easy money: Why 20% annual returns are over in crypto lending

.

.

-

Developers gathered for various crypto events in Paris last week told CNBC the days of cheap money in crypto are over.

-

Much of the lending corner of the crypto market operates in a black box.

-

Voyager Digital and Celsius competed for users on APY, but a lot of the so-called yield they offered customers wasn’t real..

.

Celsius and Voyager Digital were once two of the biggest names in the crypto lending space, because they offered retail investors outrageous annual returns, sometimes approaching 20%. Now, both are bankrupt, as a crash in token prices — coupled with an erosion of liquidity following a series of rate hikes by the Federal Reserve — exposed these and other projects promising unsustainable yields.

″$3 trillion of liquidity will likely be taken out of markets globally by central banks over the next 18 months,” said Alkesh Shah, a global crypto and digital asset strategist at Bank of America.

But the washout of easy money is being welcomed by some of the world’s top blockchain developers who say that leverage is a drug attracting people looking to make a quick buck — and it takes a system failure of this magnitude to clear out the bad actors.

“If there’s something to learn from this implosion, it is that you should be very wary of people who are very arrogant,” Eylon Aviv told CNBC from the sidelines of EthCC, an annual conference that draws developers and cryptographers to Paris for a week.

“This is one of the common denominators between all of them. It is sort of like a God complex — ‘I’m going to build the best thing, I’m going to be amazing, and I just became a billionaire,’” continued Aviv, who is a principal at Collider Ventures, an early-stage venture capital blockchain and crypto fund based in Tel Aviv.

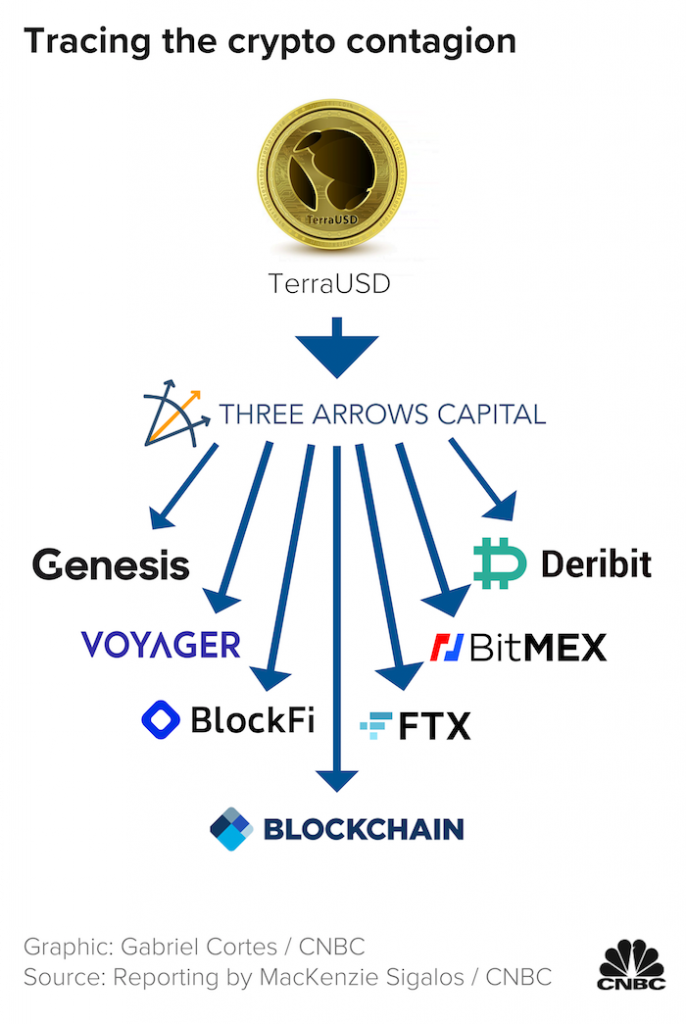

Much of the turmoil we’ve seen grip crypto markets since May can be traced back to these multibillion-dollar crypto companies with centralized figureheads who call the shots.

“The liquidity crunch affected DeFi yields, but it was a few irresponsible central actors that exacerbated this,” said Walter Teng, a Digital Asset Strategy Associate at Fundstrat Global Advisors.

The death of easy money

Back when the Fed’s benchmark rate was virtually zero and government bonds and savings accounts were paying out nominal returns, a lot of people turned to crypto lending platforms instead.

During the boom in digital asset prices, retail investors were able to earn outlandish returns by parking their tokens on now defunct platforms like Celsius and Voyager Digital, as well as Anchor, which was the flagship lending product of a since failed U.S. dollar-pegged stablecoin project called TerraUSD that offered up to 20% annual percentage yields.

The system worked when crypto prices were at record highs, and it was virtually free to borrow cash.

But as research firm Bernstein noted in a recent report, the crypto market, like other risk-on assets, is tightly correlated to Fed policy. And indeed in the last few months, bitcoin along with other major cap tokens have been falling in tandem with these Fed rate hikes.

In an effort to contain spiraling inflation, the Fed hiked its benchmark rate by another 0.75% on Wednesday, taking the funds rate to its highest level in nearly four years.

Technologists gathered in Paris tell CNBC that sucking out the liquidity that’s been sloshing around the system for years means an end to the days of cheap money in crypto.

“We expect greater regulatory protections and required disclosures supporting yields over the next six to twelve months, likely reducing the current high DeFi yields,” said Shah.

Some platforms put client funds into other platforms that similarly offered unrealistic returns, in a sort of dangerous arrangement wherein one break would upend the entire chain. One report drawing on blockchain analytics found that Celsius had at least half a billion dollars invested in the Anchor protocol which offered up to 20% APY to customers.

“The domino effect is just like interbank risk,” explained Nik Bhatia, professor of finance and business economics at the University of Southern California. “If credit has been extended that isn’t properly collateralized or reserved against, failure will beget failure.”

Celsius, which had $25 billion in assets under management less than a year ago, is also being accused of operating a Ponzi scheme by paying early depositors with the money it got from new users.

.

CeFi versus DeFi

.

So far, the fallout in the crypto market has been contained to a very specific corner of the ecosystem known as centralized finance, or CeFi, which is different to decentralized finance, or DeFi.

Though decentralization exists along a spectrum and there is no binary designation separating CeFi from DeFi platforms, there are a few hallmark features which help to place platforms into one of the two camps. CeFi lenders typically adopt a top-down approach wherein a few powerful voices dictate financial flows and how various parts of a platform work, and often operate in a sort of “black box” where borrowers don’t really know how the platform functions. In contrast, DeFi platforms cut out middlemen like lawyers and banks and rely upon code for enforcement.

A big part of the problem with CeFi crypto lenders was a lack of collateral to backstop loans. In Celsius’ bankruptcy filing, for example, it shows that the company had more than 100,000 creditors, some of whom lent the platform cash without receiving the rights to any collateral to back up the arrangement.

Without real cash behind these loans, the entire arrangement depended upon trust — and the continued flow of easy money to keep it all afloat.

….

….

.

.

——