3 ways CEOs can take sustainability programmes to the next level

.

.

-

The link between digital transformation and sustainability is often overlooked.

-

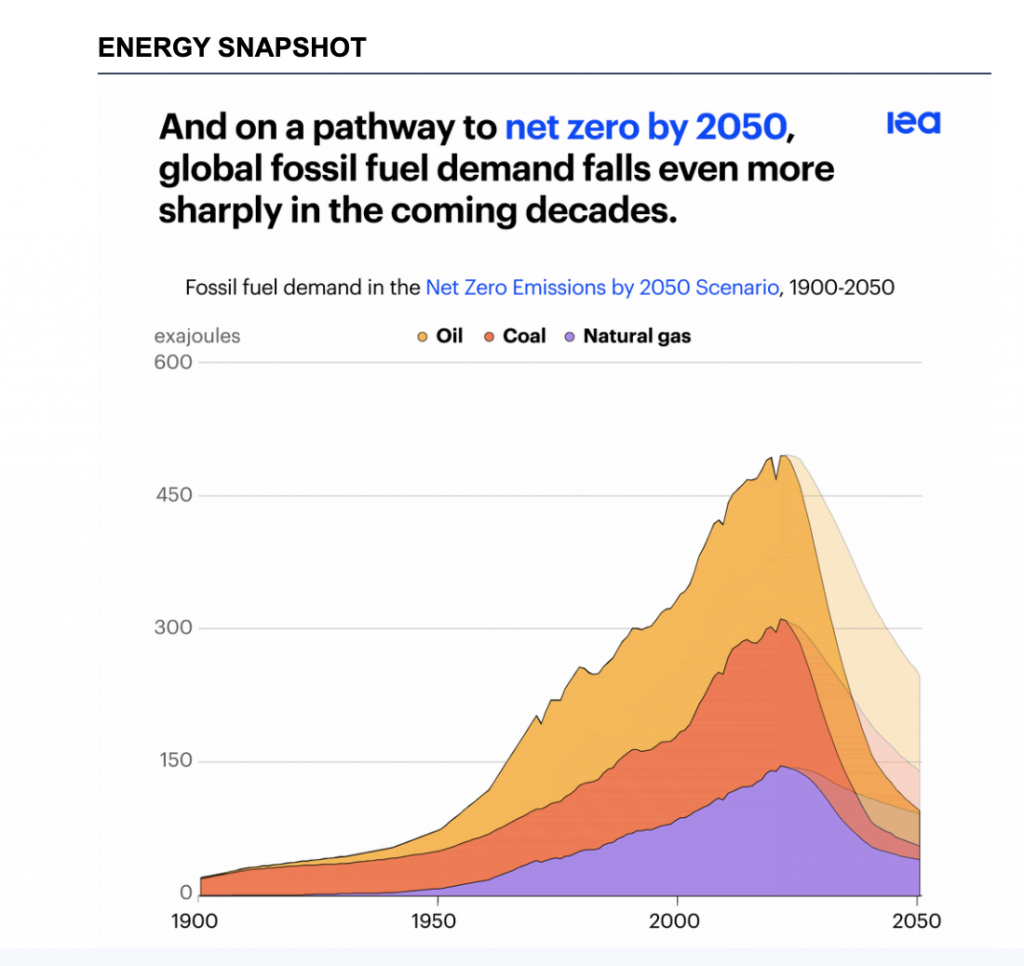

Digitalization can accelerate the path to a greener economy and society.

-

CEOs can make sustainability programmes even more effective.

.

We are entering a post-greenwashing era with the necessary shift from talking and measuring to acting for serious impact. In response, many firms have established sustainability programmes and partnerships to address social and environmental issues.

At the same time, digital technology has matured to the point where it can serve as a force multiplier for social impact. Yet the opportunity to make corporate sustainability initiatives even more effective through the use of technology is too often overlooked.

.

Many executives still view sustainability and technology as separate priorities and even opposing goals. The opposite is true, as the interplay between digitalization and sustainability opens up brilliant opportunities to create a greener economy and society.

.

In fact, sustainability transformation could even become the biggest use case for digitalization and at the same time, digital transformation will radically alter all dimensions of global societies and economies and will therefore change the interpretation of the sustainability paradigm itself.

.

Digital technologies can help deliver the Sustainable Development Goals

.

-

Smart data for accurate sustainability progress: By acquiring data from diverse and disparate sources, transforming them towards consistent data taxonomies, and using advanced analytics capabilities, digital helps to set clear standards and measure sustainability progress. Marubeni, a diversified Japanese trading company, established in its IT and logistics division an overarching data acquisition, cleansing, and harmonization process, and gained a single source of truth for its complete environmental footprint in the form of a proof of concept. This included Scope 1 and 2 emissions, energy, water, waste, hazardous materials, etc. across 12 industries with 310 subsidiaries in 66 countries.

-

Blockchain enabled circularity: Turning the circular economy promise into reality requires closing and improving the loop and capturing value from the loop for all stakeholders. On a digital level, this requires sharing and tracking product information across distributed systems and ledgers with dispersed stakeholders. Indian aluminum producer Novelis recycles production scrap and materials returned by consumers, significantly reducing raw material consumption and carbon emissions. Smart contracts enable transactions along the supply chain between all actors,e.g. on CO2/t, without sharing sensitive and proprietary information on material composition. This strengthens customer confidence in the origin and authenticity of products and ensures compliance with regulations.

-

Digital twin for supply chain modelling: To achieve transparency and traceability of resources and products along the supply chain, digital twins – digital equivalents of the physical end-to-end value chain network – play a central role. Technically, this requires a shift toward integrated planning approaches, often supported by artificial intelligence. Such an “inside-out” modelling [modelling with ll] process often begins with Scope 1 and 2 emissions, environmental footprint. In a next step, a digital twin can enable the ability to explore production and transport processes to a high level of detail and allocate emission measurements to specific product carbon footprints. With this goal in mind, Japan’s JFE Steel has established tracking and management of the product carbon footprint using primary data from the steel-making process in form of an R&D initiative. In total, JFE plans to invest $7.2 billion in low-carbon technologies to meet its 2030 target of reducing CO2 emissions by 30%.

-

Green computing: Companies must also be aware of the environmental aspects associated with the increased use of technology, e.g. an increase in energy demand. For example, this needs to be mitigated through green data centres, green cloud technology services, and the reuse of technology components. On the last point, Google recycles and reuses its data centre system components at the end of their lifecycle. A digital twin and decision intelligence allows it to forecast and schedule the reverse flow of materials back into the supply network. Google’s refurbishment rate is about 23%, while the number of resold components has increased significantly.

.

Three CEO opportunities for next-level sustainability

Digitalization, used responsibly, can significantly accelerate the path to true sustainability. These three often overlooked levers can help make today’s sustainability programmes even more effective.

.

1. Rethink business model logic

There is no doubt that the CEO plays a central role in influencing and steering the integration of sustainability into the corporate strategy and the firm’s value creation system. With this in mind, it’s surprising that only 33% of employees said that their company’s top leadership leads by example. Employees want leaders who don’t just take a stand. Driving sustainability from the boardroom requires moving from commitment to action. If leaders can’t change, the organization cannot either.

The CEO’s natural role is to rethink the company’s business models and find new ways of creating, delivering, and capturing value. However, many incumbents are still relying on yesterday’s business model logic. The first assumption to be challenged is that sustainability comes at a cost. Following the traditional logic “I do my business, I have revenue, I have costs, I make a profit, and then after I make my profit, I decide how much of my profit to give to good causes” is no longer good enough. It means I am charitable if I spend some of my profit on something good. And if I am under pressure with my profits, there is nothing to do good with.

…..

…..

.

CEOs can take sustainability programmes to the next level

.

—–

.

.