Fundraising has quickly become one of the most popular topics in the crypto community. In a falling market, the activity of smart money is only increasing. Funds tend to be the first to find promising projects and establish trends. As such, CryptoRank has compiled comprehensive research on recent crypto fundraising activity.

.

Key Highlights:

-

The market downturn has had an impact on crypto fundraising, but the overall outlook remains positive;

-

The number of M&A and debt financing transactions has increased; non-crypto companies are tending to invest in Web3 startups;

-

Large investors are launching additional funds;

-

Web3 has become the most popular category among investors.

.

The State of Fundraising

.

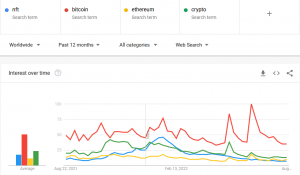

The past months have been tough for the crypto market. With all of the troubled projects, frequent exploits, bankruptcies, and negative news in the background (especially in non-crypto media), the crypto market cap is sitting around the $1 trillion mark, while less than a year ago it has almost touched $3 trillion.

The macro picture is looking bad too. Inflation is rising all across the world (except in a few countries), and governments have had to raise rates. Rate hikes have negative effects first and foremost on young companies, which is, essentially, any crypto project.

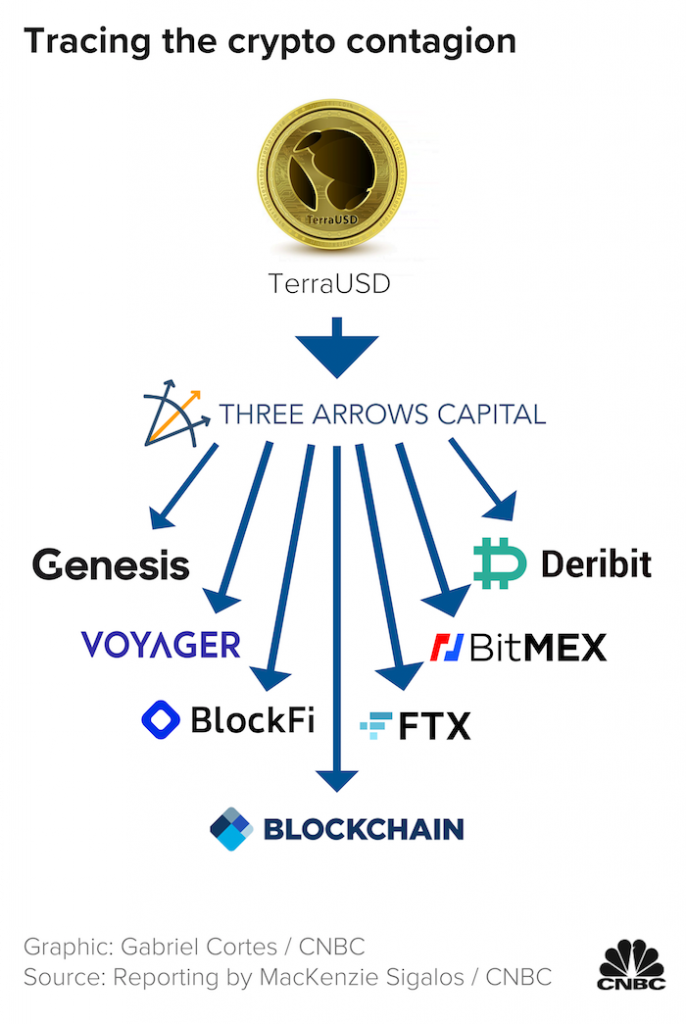

Indeed, fundraising has followed the trend, and the past months have not been as good as April 2022, when the raised amount and the number of deals reached an all-time high. However, fundraising has not performed as badly as the crypto market as a whole. It is worth noting that fundraising is an early stage investment, and it is difficult to judge the success of an investment after only a few months (sometimes even years). In addition, it is worth noting that many crypto investment funds are multi-profile companies that also might conduct trading activities, which may lead to a poor performance. A great example is Three Arrows Capital, which had an outstanding portfolio of early-stage projects, but went bankrupt due to trading losses and uncovered debt.

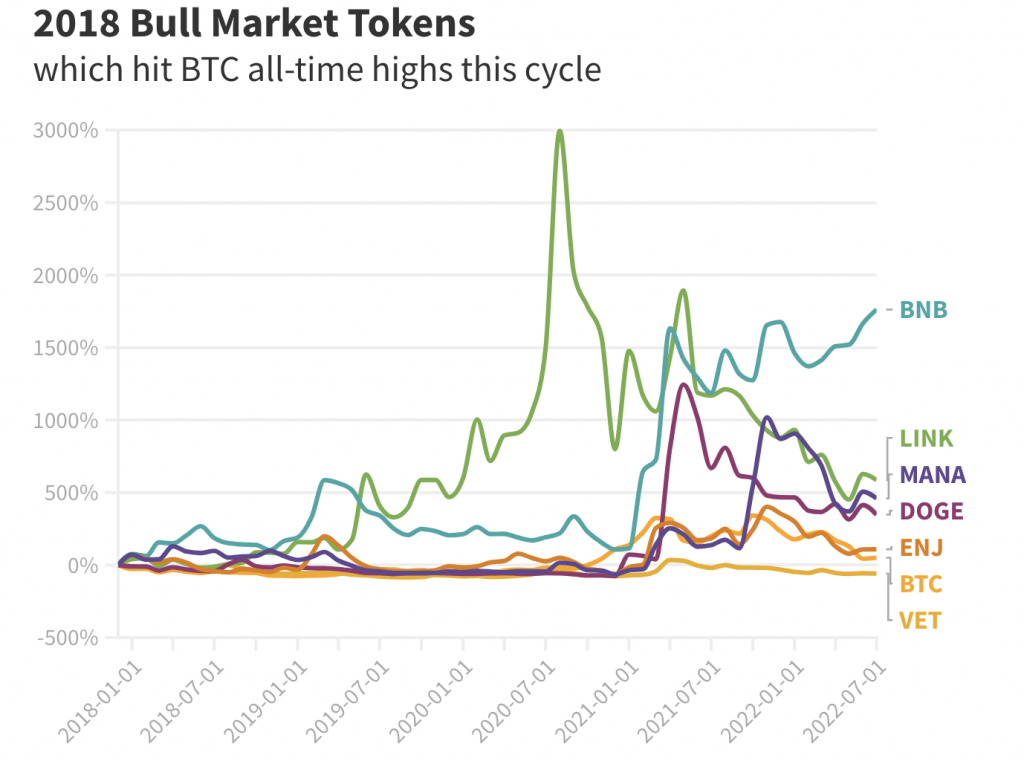

What we are seeing today is an evolution from going in blind into investments to a more thorough assessment and risk management of long-term strategies. While raised amounts and number of deals are comparatively lower than what has previously been achieved, this transition to more cautious investments will help the market to grow during the next bull-runs by filling it with high-quality projects with enough money and support from experienced leaders to sustain growth. Investors have realized that Web3 and crypto projects can exist in the non-crypto world and become real money-making businesses.

.

As we can see, the number of deals has fallen slightly, with the raised amounts falling significantly, especially in July. This means that funds are not necessarily less active, but they are tending to pick only the best of the best, and choosing to invest more modest amounts. Speaking of August, the picture over the first half of the month does not look promising. Still, we’ve seen a few notable deals including between tier 1 investment funds and promising projects. Additionally, it is worth noting that more and more non-crypto companies are investing in crypto startups despite the market downturn.

As mentioned above, Web3 as a category is dominating among crypto projects that raised funds in 2022. The number of Web3 projects shows that it is one of the most sought-after startup categories . Investors are seeking such projects since Web3 is on the verge of mass adoption.

Blockchain infrastructure and centralized finance, on the other hand, have raised the highest amounts of $8.79 billion and $8.44 billion respectively. Many prospective blockchains are raising significant amounts, but more on that later. While a core part of crypto is its “decentralization”, it also relies heavily on centralized organizations. First of all, these are exchanges and trading platforms, which help to explore new markets and bring new users to crypto. In essence, centralized finance is crucial to mass adoption by institutions.

.

.

A total of $30 billion has been raised from 1412 deals so far in 2022 . The number of deals and totals may be higher due to undisclosed amounts of investment from private investors. Yet still, it perfectly describes the current state. In one of our recent posts (https://t.me/CryptoRankNews/7239) we provided a breakdown of monthly fundraising volumes by categories over the year. The data shows that NFT was raising higher amounts during the period from the end of 2021 — beginning of 2022, while Web3’s raises significantly accelerated in this year’s second quarter.

.

Crypto VCs are the New Gurus of the Bear Market

Crypto investment funds are the trendsetters. At a time when it is difficult to find good investment opportunities on the public market, large funds are regularly discovering new projects at early stages. Investment managers have become new gurus for the selection of promising cryptocurrency projects, creating new trends in the industry. Tracking their portfolios might be extremely useful for those who want to find early-stage prospective projects and potential airdrop or whitelist opportunities.

Despite the fact that the main goal of cooperation between a project and the VC remains funding, priorities are changing. As mentioned above, the behavior of funds has changed from extensive portfolio expansion to the selection of better projects to support development. This guidance is also important for projects that intend to develop a complete product, as such,interaction between funds and projects has expanded to help in organizing processes, finding employees, and other areas of growth.

Now, in addition to traditionally governed investment funds, decentralized autonomous organizations has become a new trend for running investment funds. Some of them are showing as good as performance as tier 1–2 VC funds, however, they often come across some pitfalls.

.

.

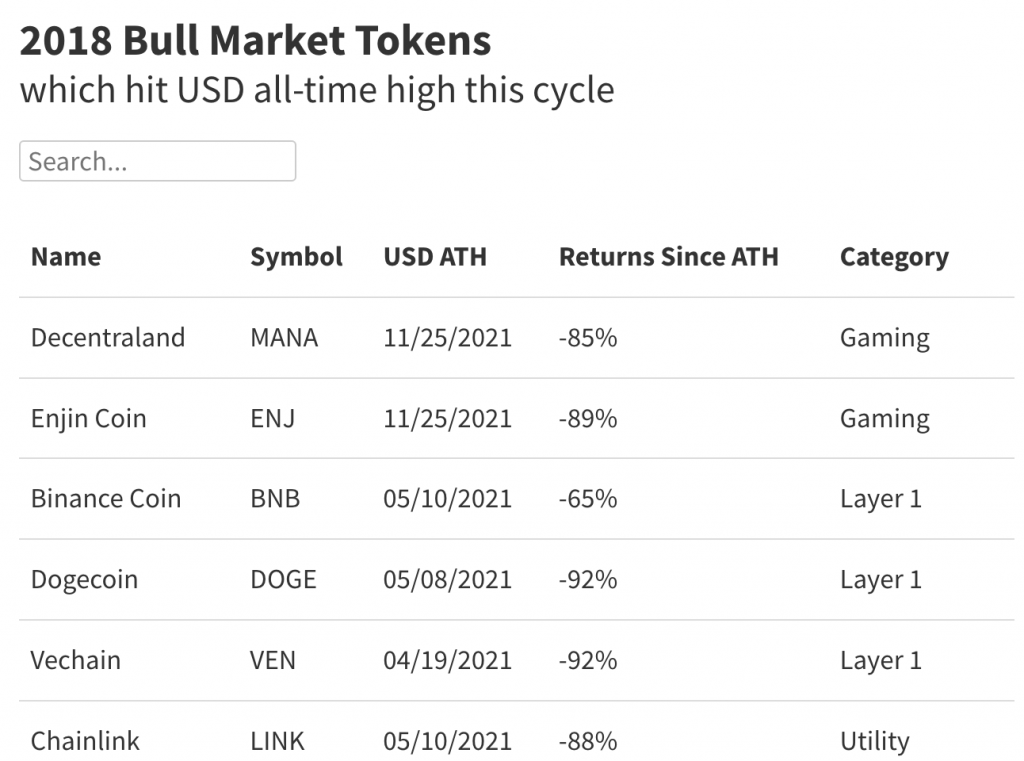

Gaming Guilds stand out as a DAO category, they primarily invest in GameFi projects. Some of them are struggling due to market downturn. The is exasperated by that fact that in-game assets (NFTs, utility tokens) may lose their value much faster than the broader market due to changes in in-game mechanics or play to earn rewards. For example, the token of one of the most popular blockchain games, Axie Infinity, has lost over 90% of its value since its ATH in November 2021. The same goes for their NFTs, which are required to play the game and earn rewards. However, the GameFi industry is quickly developing, and many guilds have already made confident bets on upcoming projects, which may even overtake established leaders as Axie Infinity.

Recently, several major VCs have announced the launch of new high-volume funds. Of note, Sequoia Capital has launched three region-specific funds (China, India, and Southeast Asia) totalling $11.85 billion.

.

.

On CryptoRank.io you can track performance of over 250 major crypto investment funds, including their publicly traded assets and upcoming projects.

.

.

Notable Venture Deals

There were plenty of venture deals in 2022 that are worth attention and analysis. We are half way through 2022 and it has already became the most important year for crypto fundraising, despite the market downturn. Arguably the most important fundraising event over the past 30 days was the Series A investment round of Aptos, led by FTX Ventures and Jump Crypto.

.

Overall, projects are raising lower amounts and valuations are tending to be lower. Nevertheless, many companies are still coming out with new record valuations. Note that the valuations do not appear by coincidence. They reflect future cash flows, and for such significant values, it must be really impressive profits or growth rates. This once again underlines that the crypto industry can make a profit no worse than traditional finance.

.

It is worth mentioning Animoca Brands, which recently raised $75 million with a $5.9 billion valuation. Animoca has an outstanding portfolio and is one of the most active investors today. This is a great example of how a company investing mainly in Web3 projects can compete with traditional financial investors.

The poor state of the market has led to an increase in merger and acquisition deals and debt financing. Companies on the verge of bankruptcy (most of which are DeFi projects), for some investors, are an attractive prospect. For example, Sam Bankman-Fried (FTX, Alameda Research), Changpeng Zhao (Binance) and Justin Sun (TRON) have expressed their readiness to save some projects from extinction. However, such investments are a very long game, besides, not many projects have a real chance of survival.

Among the recent M&A deals, it is worth highlighting following:

The mixing of cryptocurrency projects and other companies is continuing to grow and gain momentum. Large projects, such as Uniswap, are doing well by expanding their activities into new areas. NFT is probably the closest to fully-fledged mass adoption, many non-crypto companies are beginning to understand the sector and are ready to develop in this direction.

This fundraising data, in a way, describes the current state of the crypto market, even without mentioning global market cap and price of Bitcoin. Obviously, the activity has slightly decreased over the past few months, and raised amounts are not as high as previously seen. However, investors are finding new promising projects and investing funds into already proven quality ones and thereby stimulating their growth. In a similar way, the market is also being “cleaned up”: weak projects are losing users, followed by their cryptocurrency rate falling.

We are witnessing the accelerating integration of cryptocurrencies into traditional financial institutions, as well as the arrival of a huge number of new users in Web3. It is quite possible that very soon Web3 will become a part of our daily life, as Web 2.0 once became. After all, it is no wonder that many of the large companies of the previous generation are the same investors who are now actively investing in Web3 projects.

Blockchain makes the changes currently taking place available for many users to participate, not just to a select few and large foundations. The widespread amount of information available publicly are allowing crypto enthusiasts to follow the activities of large funds, and the projects themselves are prepared to listen to users and reward them for their input. This is also a distinctive feature of Web3.

.

To keep up-to-date on fund performance you can visit the Funds page on CryptoRank: https://cryptorank.io/funds

.

The State of Crypto Fundraising

.

—-