YC Partner Geoff Ralston gives an introduction to the key concepts to keep in mind once you enter a fundraising process.

https://blog.ycombinator.com/fundraising-fundamentals-by-geoff-ralston/

Bloggin internal news

YC Partner Geoff Ralston gives an introduction to the key concepts to keep in mind once you enter a fundraising process.

https://blog.ycombinator.com/fundraising-fundamentals-by-geoff-ralston/

Happy Friday!

Our research team tracked 50 tech funding deals worth more than €279 million, as well as 5 M&A transactions and 1 IPO across Europe, including Russia, Israel, and Turkey.

We listed every single deal in our weekly newsletter (note: the full newsletter is now available to paying subscribers only). Here’s an extra overview of the 10 biggest European tech news items for last week:

1) Apple is taking control over the power-management technology at the heart of its iPhones in a $600 million deal with Dialog Semiconductor that also secures the German-listed company’s role as a supplier to the US tech giant.

2) Copenhagen-based visual effects startup Spektral was acquired by Apple for $30 million at the end of 2017 in a deal that was only disclosed this week. The company focused on applying machine learning techniques to image and video editing.

3) Helsinki-based Varjo, founded in 2016, has secured a $31 million Series B investment led by Atomicoto bring its technology to market as what it claims is the world’s first VR / XR hardware and software product specifically aimed at industrial use. The round, which brings Varjo’s total funding raised to $46 million, was joined by Next47, the Siemens-backed venture firm, as well as previous backers EQT Ventures and Lifeline Ventures.

.

http://tech.eu/brief/these-were-the-10-biggest-european-tech-stories-this-week-october-12/

When you start a business, there are many financing options to consider — friends and family, small business loans, angel investment, VCs — but there is no textbook solution for getting a new business off the ground.

One option that entrepreneurs, investors, and average Joes love to love is bootstrapping. Rather than seeking external funding, entrepreneurs who bootstrap their companies rely on savings, early cash flow, and conservative money management. The age-old concept of the American dream lives on in the world of startups — we have pulled ourselves up by our bootstraps.

My co-founders and I have confronted the good, the bad, and the ugly of choosing not to use outside capital in the inception and growth of Ampush. Here’s my take on the double-edged sword known as bootstrapping:

Retaining Full Control

Without a board to impose its ideas, timelines or limits, we are able to be opportunistic, nimble and adaptive. We determine which strategic vision to follow. Since we don’t have to wait for approval, we can execute that vision or make changes at our own speed. We also learn at our own pace; we make mistakes but keep going. By retaining full control of the company, my co-founders — the people who understand the business best and run it day to day — and I are in control of its future.

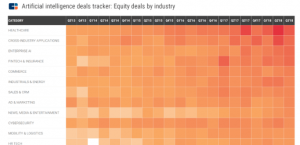

We used the CB Insights platform to track AI deals across all industries, from healthcare and cybersecurity to mobility and logistics.

.

I see hundreds of fundraising decks each year. I’ve been doing this for eight years now, so I’ve been able to see some longitudinal trends during that time.

There are a couple trends that I have noticed emerge over the last few years that I think have become industry standard. The problem is that I think they don’t work and need to be rethought. Not sure if this is going to be true for every investor out there, but this is definitely true for me.

Below are a couple things I’d change, and a proposed structure that I’d recommend for most fundraising decks. This is what I’d recommend for founders that are raising a more mature seed or series A that has at least early signs of Product/Market Fit.

https://bettereveryday.vc/rethinking-the-standard-fundraising-deck-406c9061e1c3

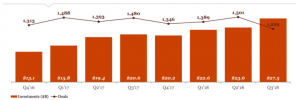

PwC and CB Insights‘ Q3 2018 MoneyTree report highlights the latest trends in venture capital funding globally.

Dollars were up 17% in Q3’18 as $27.5B was invested across 1,229 deals. Deal activity declined for the first time since Q4’17.

![]()

Often the opposite of disruption is the status quo.

If you’re a startup trying to disrupt an existing business you need to read The Fixer by Bradley Tusk and Regulatory Hacking by Evan Burfield. These two books, one by a practitioner, the other by an investor, are must-reads.

The Fixer is 1/3rd autobiography, 1/3rd case studies, and 1/3rd a “how-to” manual. Regulatory Hacking is closer to a “step-by-step” textbook with case studies.

Here’s why you need to read them.

One of the great things about teaching has been seeing the innovative, unique, groundbreaking and sometimes simply crazy ideas of my students. They use the Business Model (or Mission Model) Canvas to keep track of their key hypotheses and then rapidly test them by talking to customers and iterating their Minimal Viable Products. This allows them to quickly find product/market fit.

Except when they’re in a regulated market.

VC FUNDING / THU 4 OCT 2018

As most tech entrepreneurs will know, fundraising can help you secure market share, grow your business and build a killer product, but it can also be extremely daunting and time consuming.

According to UKTN’s Investment tracker, UK founded technology businesses raised more than £4bn in 2017, with the same data showing that companies in the space have already surpassed the £2bn mark so far this year.

Raising from the right investors, at the right time, on the right terms is key for business success. So, bearing in mind that companies are operating in an extremely competitive market, we partnered with professional services firm Smith & Williamson, to host a panel discussion in a bid to demystify what the fundraising process entails for both founders and investors.

https://www.uktech.news/guest-posts/funding/vc-funding/70652-20181004

Salvatore Minetti, CEO and founder, Prospex.ai on how to decide what type of funding is best for your tech business.

The UK has established itself as one of the best countries in the world to start and grow a business. In fact, between 2012 and 2017 approximately 3.5 million new companies were founded across Britain.

There are several reasons for this boom in entrepreneurialism, but financial support has proven demonstrably important. Specifically, a combination of private sector investment coupled with public sector initiatives have helped nurture an environment where early stage businesses can secure vital capital to enable them to grow.

Entrepreneurs in the UK are fortunate to have a plethora of places to turn when looking to secure finance for their fledgling company. Yet despite all these options – or perhaps because of the vast number of choices now available – the task of raising investment can be daunting for a startup.

https://www.uktech.news/news/70647-20181002