This is the first in our series on how to grow your startup from seed stage (where you have developed your prototype with some angel funding) to being worthy of a series A investment.

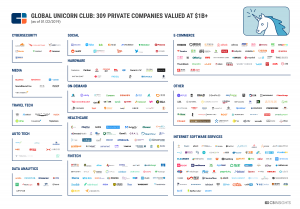

The market size or total addressable market (TAM) is very likely the first filter any VC will use to screen your startup. If the TAM is too small, then your startup is an easy pass.

But in reality, most consumer-focused startups we see in Asia have very large TAMs, and only few B2B startups are targeting markets that are too small.

Nevertheless, you need to be able to define and quantify your TAM when pitching for investment.

Why is TAM so important?

Early-stage investors like us always look for companies who are capable of returning at least 50x on an investment. If the average seed-stage company in Hong Kong or Singapore is valued at around US$5 million, then we would need to see a path for a company to achieve a US$250 million valuation.

https://www.techinasia.com/talk/validating-tam