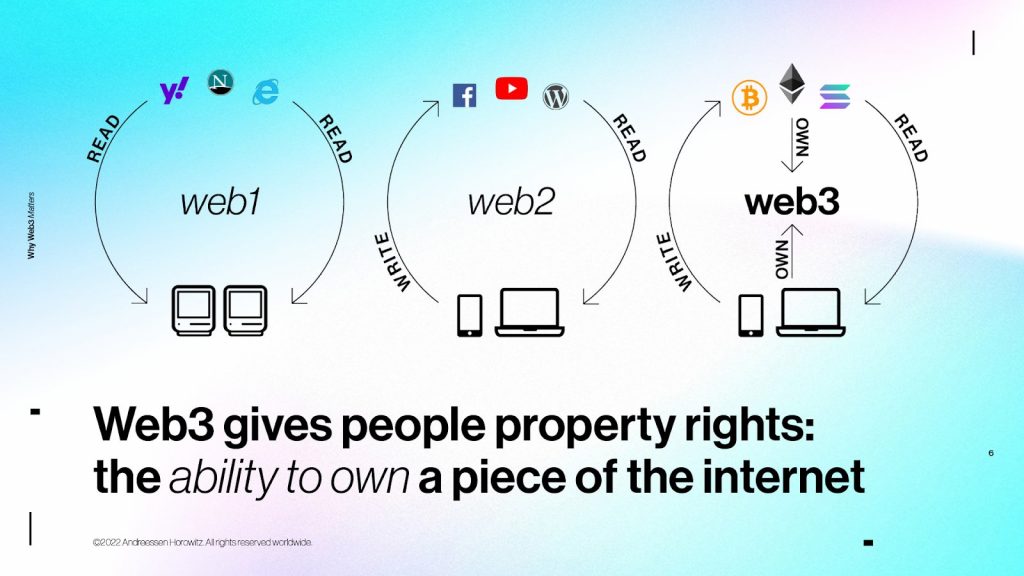

Royalty-integrated equity (RIE) is a form of equity that the blockchain enables which addresses both shifting business incentives away from pure profits and growth, and also can create a more accessible form of capital ownership.

Simply put, RIE is a fungible token that integrates royalty payments on transfer. In other words, RIE creates shares of stock in companies that can pay small royalty fees back to their respective companies when they are traded. How does this work?

Currently, there is a standard for NFTs to be built with royalties: a function in their smart contracts that pay back small percentages to the original creators. This could be implemented in cryptocurrency tokens, taking the royalty from the payment for transferring the tokens. So when a token is traded on an exchange, a small fee is paid back to the token issuer (and likely the exchange).

With RIE, buying shares in a company would mean not just investing in that company’s stock, but sending money directly to them in the process.

Previously, I wrote about the Blockchain Web, a concept for applying blockchain to improve current internet services. This sequel models an alternate vision of monetization and financial success for businesses in the Blockchain Web, leveraging the new technology.

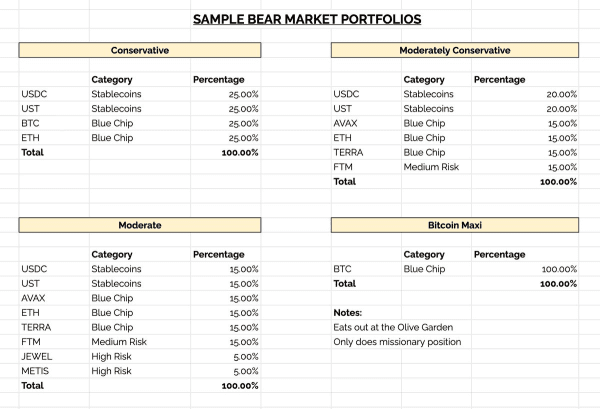

Notably, this does not include DeFi solutions, but rather follows a different line of economic incentives. I’ll discuss the current economic environment and the alternate vision from web3. With these in mind, we can look at how a new form of equity—combining aspects of current company equity and the emerging tokenomics—can shift incentives to more stable, useful and better distributed outcomes.

Today’s Economic Model

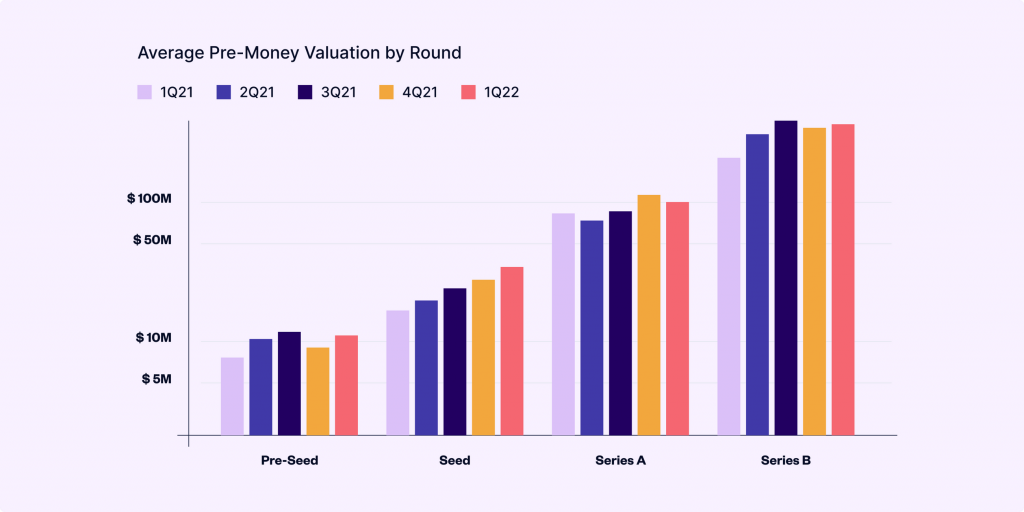

The internet business model is as capitalist as it gets, with a severe prejudice for growth over anything else, be it in user numbers, usage statistics, or profits. This is demonstrated in companies like Facebook or Apple being measured by their growth in usage and ad revenues. In The Nature and Logic of Capitalism, Robert L. Heilbroner points out how central to capitalism is “the use of wealth in various concrete forms, not as an end in itself, but as a means for gathering more wealth.” As the internet companies follow this constant drive for more and to be bigger, they dominate: Big Tech has become the oligarchical ruling class of the internet ecosystem.

Heilbroner describes how this affects dynamics of the members within this ecosystem:

.

A Business Model for the Blockchain Web

.

—–