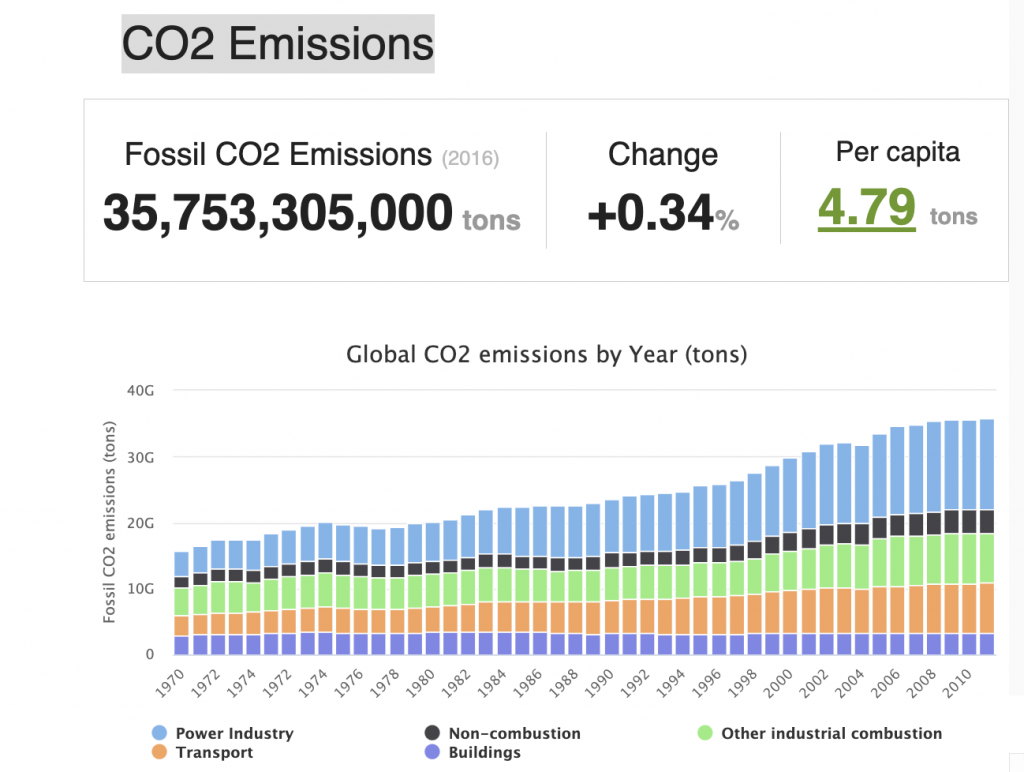

Despite whispers of a downturn earlier this year, investors continue to express confidence in climate tech. Though numbers are down compared with 2021, a year that many agree is an outlier in the VC world, they’re on track to beat 2020 as the second hottest year for investment.

What’s more, deal counts and values were up in the second quarter of this year compared with the first, suggesting that the slowdown has more or less skipped climate tech.

Though deal count is down nearly 19% compared with last year, it was up 15.4% in the second quarter, according to a PitchBook analysis. Total market deal value, down year over year, was up significantly in Q2, and the average value per deal has held steady at $23.6 million, more than triple what it was five years ago.

In some ways, those modest numbers could be interpreted as a slight cooldown. But the sector is probably just taking a breather given its near-term potential. Just five years from now, PitchBook estimates the climate tech market will near $1.4 trillion, representing a compound annual growth rate of 8.8%.

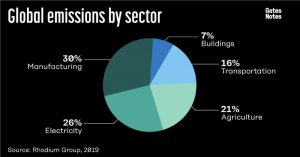

With that kind of growth coming down the pike, there are a lot of different bets to place in the climate tech sector, but a few stand out for their early-stage potential and favorable tailwinds.

.

Climate tech is a hot investment in 2022

.

—–

.

.