To beat the bear, you have to think like the bear. Here’s how…

.

Dear Bankless Nation,

If this is your first bear market, you’re probably fighting the urge to bury your head in the sand and wish that it all just goes away.

Don’t do that!

There’s a lot to be gained from engaging with Web3 in times like these — you just have to adjust your perspective.

Today, Frogmonkee offers up strategies for beginner, intermediate, and advanced crypto traders that will have you best positioned for the next bull market.

We’ve also got some words of wisdom on how to keep your mind focused.

Remember: To beat the bear, you have to think like the bear.

Let’s do it together.

.

– Bankless

.

—–

First things first: are we in a bear market?

Let’s get our basic definitions aligned. Let’s consider the definition offered by our old friend Investopedia:

“A bear market is when a market experiences prolonged price declines. It typically describes a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment.” – Investopedia

Okay, we have questions: What are “prolonged price declines?” How is “pessimism and negative inventor sentiment” defined? “20%” drops? That’s a bad Tuesday in crypto. In 2018, the market experienced drawbacks of 80% or more. Okay, so let’s try another way…

.

David put it well when he wrote:

“Instead of trying to categorize recent price action as a bear market or not, ask yourself, does this feel like a bear market? If yes, then act accordingly. If not, then act accordingly.” – 5 reasons to be excited for the bear market

In my degen niche of crypto, I’ve noticed a tangible retraction in enthusiasm. Fewer people are apeing into new NFT projects or taking risks with small-cap tokens, while more are converting their tokens into ETH/BTC or stables.

A quick look at the market shows we’re far, far down from ATHs. According to CMC, crypto’s market cap peaked back in early November at just under $3T. As of writing, crypto sits at roughly $1.25T.

That’s a 58% fall over the span of 7 months.

Even after accounting for crypto’s volatility, we’re still looking at three times the drawdown from the 20% heuristic.

….

….

….

Evaluating your risk profile

Before we dive into any strategies, I want to first talk about risk profiles. A risk profile is a tool that investors use to identify if a particular investment falls within their appetite for risk. Here are some high-level examples:

.

Aggressive Risk Profile

-

Mostly small cap tokens, some BTC and ETH, no stables.

-

Willing to use protocols that have not been audited

-

Invests across dozens of different projects

.

Moderate Risk Profile

-

Majority BTC and ETH, some stablecoins, and some small cap tokens

-

Stakes in higher yield pools, but is determined to understand the protocol first

-

Uses a small percentage of portfolio to ape into projects

.

Conservative Risk Profile

-

Entirely BTC, ETH, and stables

-

Stables are parked in a Compound market earning low single digit yields

-

Does not keep more than 5-10% net worth in crypto

.

Having a risk profile in mind will frame what types of investments you pursue in general. For a bear market, I’d recommend between a conservative to moderate risk profile as more aggressive risk profiles benefit from market manias indicative of bull markets.

.

.

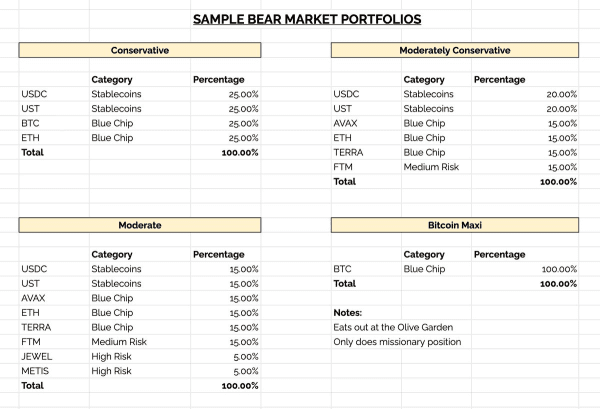

A few Sample portfolios for the bear market:

• Figure out your balance: stables, low risk, medium risk, & high-risk plays.

• Then decide on Projects. I created a few sample portfolios for you to look at. (education, not financial advice )

.

How to Survive a Crypto Bear Market

.

.

——